Buying a home often starts with one big question: How much house can I actually afford? While online calculators can spit out a number that looks appealing, mortgage lenders use very specific guidelines to determine what you qualify for. One of the most important of those guidelines is your debt-to-income ratio (DTI).

We break down how lenders calculate DTI, how to estimate an affordable monthly payment, and how factors such as credit score and down payment fit into the bigger picture.

Step 1: Understand Debt-to-Income (DTI)

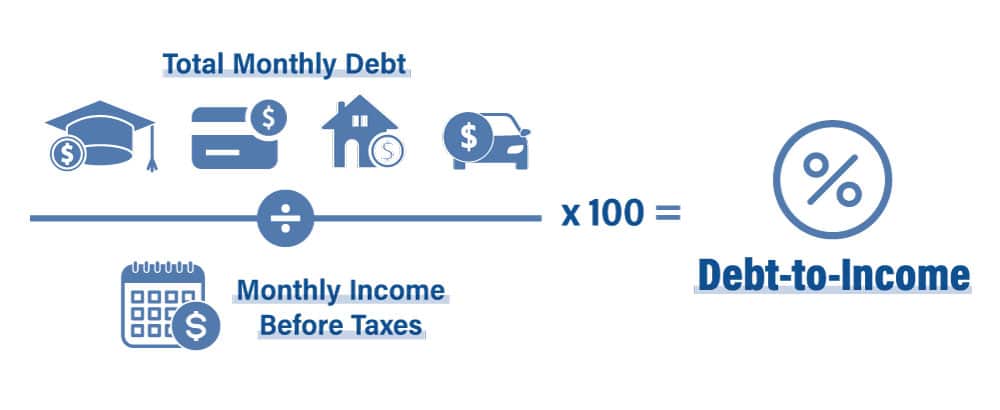

Your debt-to-income ratio compares how much you owe each month to how much you earn before taxes. Lenders use this to evaluate whether you can reasonably take on a mortgage payment.

The Basic Formula

Total Monthly Debt ÷ Gross Monthly Income = DTI

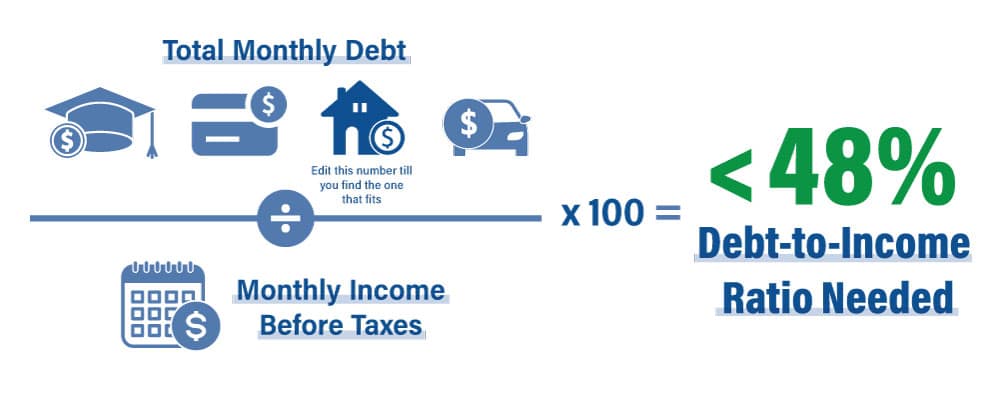

Most mortgage lenders look for a DTI below 48%, though some loan programs may allow slightly higher or require lower, depending on your overall profile.

What Counts as Monthly Debt?

When calculating DTI, lenders include recurring monthly obligations that appear on your credit report. Common examples include:

- Student loan payments

- Credit card minimum payments

- Auto loans or leases

- Personal loans

- Child support or alimony (if applicable)

Every one of these payments adds to your total monthly debt.

How to Calculate Your Own DTI

One of the easiest ways to understand affordability is to work backward.

- Start with your gross monthly income (before taxes).

- Multiply that number by 48% to find your maximum allowed monthly debt.

- Add up your existing monthly debts, then subtract the result from the number above. This will give you an idea of what you can afford.

- Adjust the estimated mortgage payment until your total debt stays below the 48% threshold.

This approach lets you see, in real time, how changing one number, like a car payment or student loan, affects what you can afford on a home.

What Counts as Monthly Income?

Just as lenders carefully review your monthly debts, they also have specific rules about what counts as income when calculating your debt-to-income ratio. In most cases, income must be stable, predictable, and likely to continue.

Common Types of Qualifying Income

Mortgage lenders typically allow the following sources to count toward your gross monthly income:

- Salary or hourly wages from your primary job

- Overtime, bonuses, or commissions (with documentation)

- Income from a second job or side gig

- Child support or alimony received

- Self-employment or freelance income

How Long Do You Need to Receive the Income?

In general, lenders want to see a history of at least 2 years of variable or non-salary income, or time spent studying in college for recent graduates. This helps demonstrate consistency.

- Overtime, bonuses, and commissions usually require a two-year history

- Second jobs or side income typically must be documented for two years and expected to continue

- Self-employment income is usually averaged over the last two years

- Child support or alimony received must be documented and expected to continue for at least three years after the loan closes

If income is new, irregular, or short-term, a lender may not be able to use it, even if it’s currently boosting your budget.

From Monthly Payment to Home Price

Once you have a comfortable monthly mortgage payment range, the next step is translating that payment into a home price.

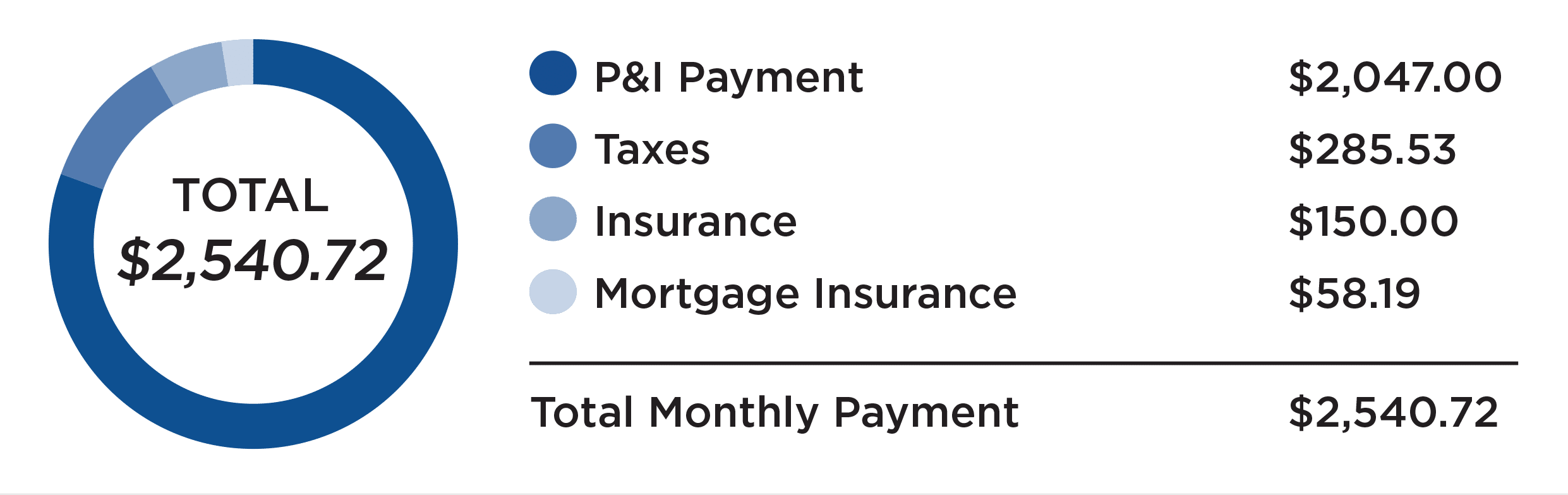

Your monthly payment isn’t just the loan amount—it usually includes:

- Principal and interest

- Property taxes

- Homeowner’s insurance

- HOA dues (if applicable)

Example breakdown:

Because of this, two buyers with the same monthly payment limit may qualify for very different home prices depending on taxes, insurance costs, and loan terms.

Speaking with a mortgage loan advisor early in the process gives you a clear picture of what price range you can afford in the neighborhoods you’re considering.

How Your Down Payment Factors In

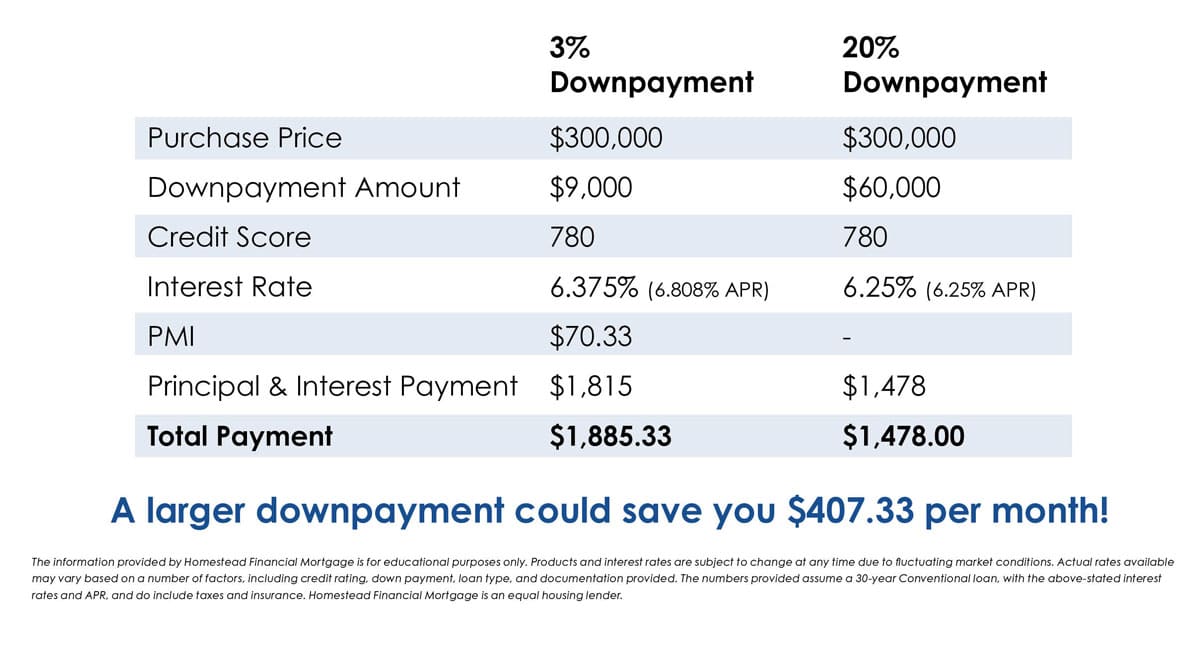

Your down payment directly affects how much house you can afford, and each loan program will have different requirements.

- A larger down payment reduces the loan amount, which lowers your monthly payment.

- A smaller down payment means borrowing more, which can increase your monthly payment and your DTI.

Down payment size can also influence whether you need mortgage insurance, which adds to your monthly cost and impacts affordability.

The Role of Credit Score

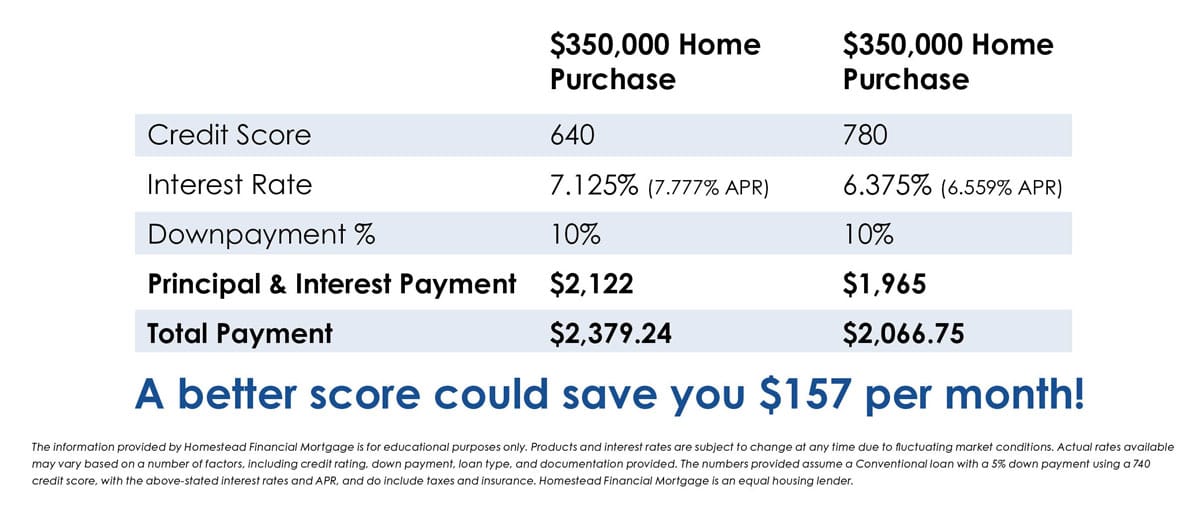

While DTI determines how much debt you can carry, your credit score influences how expensive that debt is.

In general:

- Higher credit scores qualify for lower interest rates

- Lower interest rates mean lower monthly payments

- Lower payments improve your DTI

That means two borrowers with the same income and debts could qualify for different loan amounts simply because of their credit scores. See the comparison example shown above.

Affordability vs. Comfort

Just because a lender approves a certain loan amount doesn’t mean that payment will feel comfortable in your day-to-day life. Mortgage guidelines are designed to measure risk, not lifestyle. They don’t account for expenses like:

• Childcare costs

• Groceries

• Utilities

• Travel or savings goals

That’s why it’s important to view the debt-to-income ratio as a starting point, not a spending target. Choosing a payment that fits comfortably within your broader budget can help you enjoy homeownership without feeling financially stretched.

Putting It All Together

Understanding how much house you can afford begins with knowing how lenders look at your financial picture. By evaluating your debt-to-income ratio, estimating a realistic monthly payment, and considering how factors like credit score and down payment will affect it, you can enter the home search with clarity and confidence. Once you’ve identified a monthly amount that works for both lender guidelines and your lifestyle, a mortgage professional can help translate that number into a home price that supports your long-term financial goals, not just your approval letter.