Buying a home is one of the biggest financial decisions many people will ever make, and your credit plays an important role in the process. Whether you’re actively house hunting or just starting to explore your options, understanding how credit scores work can help you make more confident, informed decisions. The average American has a credit score in the low 700s, and many successful homebuyers fall right into that range, showing that homeownership doesn’t require perfect credit.

This guide breaks down what a credit score is, how it’s calculated, how credit score requirements vary by mortgage loan type, and how the debt-to-income ratio also impacts your ability to qualify for a home loan.

What Is a Credit Score?

A credit score is a three-digit number lenders use to help determine how likely you are to repay borrowed money. It’s based on your past credit behavior and is meant to reflect your overall credit risk. Most mortgage lenders use FICO® credit scores, which range from 300 to 850.

Higher credit scores generally lead to more loan options, better interest rates, and lower monthly payments, but many borrowers with average or even below-average scores still qualify for home loans, depending on the loan type.

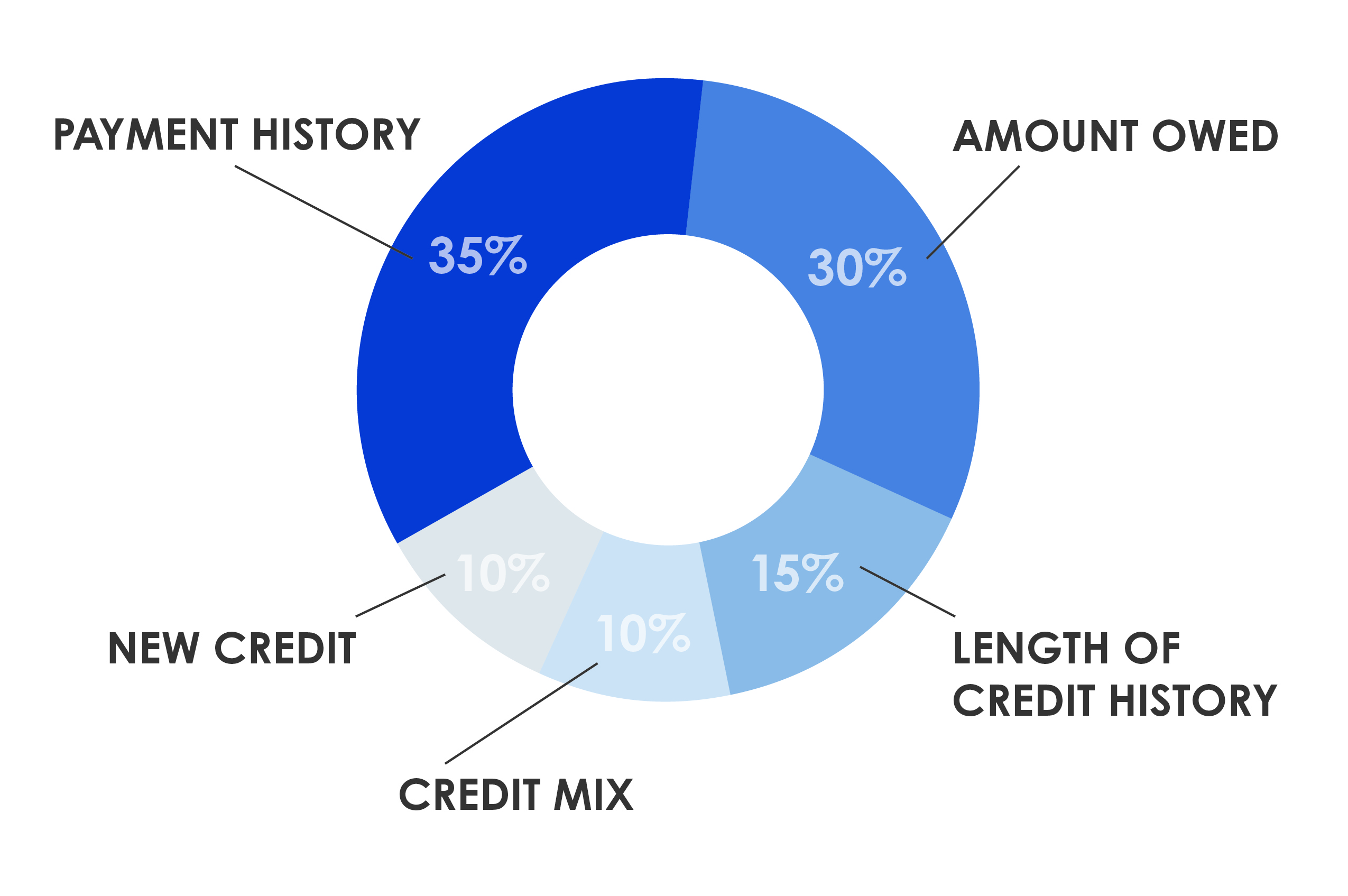

How Is a Credit Score Calculated?

Your credit score is calculated using several key factors, each of which plays a different role in lenders’ assessment of your creditworthiness.

Payment History (35%)

This is the most important factor in your credit score. It reflects whether you’ve paid past credit accounts on time. Late or missed payments can significantly lower your score, especially if they are recent. A payment that is 30 days late can cause a noticeable drop, and payments that are 60 or 90 days late are even more damaging. Late payments can remain on your credit report for up to seven years, though their impact lessens over time if you establish a strong pattern of on-time payments moving forward.

Amounts Owed (30%)

This factor looks at how much debt you carry compared to your available credit, often referred to as credit utilization. Using a large percentage of your available credit can lower your score, even if you pay on time. For example, maxing out credit cards can signal financial strain to lenders. Keeping balances lower, especially below 30 percent of available limits, generally supports healthier credit scores.

Length of Credit History (15%)

The length of time you’ve had credit accounts open matters. Older accounts help show stability and experience in managing credit. Closing old accounts can sometimes reduce the average age of your credit, which may temporarily affect your score. This is one reason it’s often better to keep long-standing accounts open, even if they aren’t used frequently.

Credit Mix (10%)

Lenders like to see that you can manage different types of credit responsibly. This may include credit cards, auto loans, student loans, or other installment loans. You don’t need every type of credit, but having a mixture can positively influence your score.

New Credit (10%)

Opening new credit accounts or applying for multiple loans in a short period can slightly lower your score. Each application typically results in a hard inquiry, which can stay on your credit report for up to two years. This is especially important to keep in mind when preparing to apply for a mortgage.

What Credit Score Do You Need to Buy a Home?

There’s no single “magic number” when it comes to qualifying for a mortgage. The credit score needed to buy a home can vary based on the type of loan you’re applying for, as well as individual lender guidelines.

Conventional Loans

- Typical minimum credit score: 620

- Typical score needed for the best interest rates available: 740 and above

- Conventional loans often require stronger credit but reward borrowers with more competitive rates and flexible terms when credit and income are solid.

FHA Loans

- Minimum credit score options:

- 580 with a 3.5% down payment

- 500–579 may qualify with 10% down, depending on lender guidelines

- FHA loans are designed to help first-time buyers and borrowers with lower credit scores or limited credit history.

VA Loans (for eligible Veterans and service members)

- No official minimum credit score is set by the VA

- Many lenders prefer scores in the 580–620 range, or higher

- No down payment is required in most cases, making this a strong option for eligible borrowers.

USDA Loans

- Typically require a credit score of around 640 or higher

- Available for eligible rural and suburban areas

- Income limits and property eligibility requirements apply.

Important: Individual lenders may set stricter credit score requirements than the loan programs themselves, which is why working with a knowledgeable and trusted loan advisor can help you identify the best options for your specific situation.

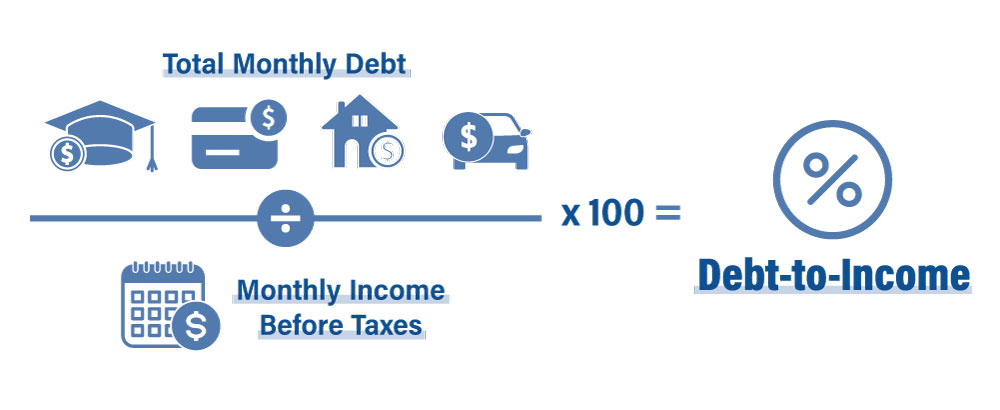

How Debt-to-Income Ratio Affects Home Buying

In addition to your credit score, lenders look closely at your debt-to-income ratio, or DTI. This measures how much of your monthly income goes toward paying existing debts, including the estimated mortgage payment.

Different loan types allow for different DTI thresholds. Conventional loans often cap DTI around 45 percent, while FHA loans may allow higher ratios for borrowers with compensating factors, such as strong credit or savings. VA loans place greater emphasis on overall affordability and residual income than on strict DTI limits, while USDA loans typically have more conservative DTI requirements.

Your credit score and DTI work together. A higher credit score can sometimes help offset a higher DTI, and certain loan programs are designed to be more forgiving in one area if you are strong in another.

Credit Karma Scores and Mortgage Credit Scores

Many buyers check their credit using free tools like Credit Karma, which can be helpful for monitoring trends and spotting changes. However, Credit Karma uses VantageScore models, while mortgage lenders typically use FICO scores. As a result, the score you see online may not match the score a lender uses for your mortgage application.

While these tools are useful for general awareness, they should not be relied on as an exact measure of mortgage readiness.

Getting a Free Copy of Your Credit Report

You can obtain a free copy of your credit report from each of the three major credit bureaus at AnnualCreditReport.com. Reviewing your credit report allows you to check for errors, understand what’s impacting your score, and address potential issues before applying for a mortgage.

Why You Should Avoid Credit Changes While Home Shopping

One of the most important things to remember when preparing to buy a home is to avoid making changes to your credit without first talking to your loan advisor. Opening new accounts, making large purchases, paying off debts, or even closing accounts can unexpectedly affect your credit score or debt-to-income ratio.

Even well-intentioned moves can cause delays or impact loan approval. A loan advisor can help you determine which actions will benefit your mortgage application and which should wait until after closing.