Credit card balances are on the rise. In February 2024, the Federal Reserve released data showing that balances had reached a new record high of $1.13 trillion. That’s an increase of $50 billion in the fourth quarter of 2023 alone.

It’s a potentially concerning situation because with the increase in balances, delinquency rates have gone up, and so have interest rates. We will dive a little deeper into the numbers and discuss how the record amount of equity in your home can help your cash flow.

Credit Card Balances are Up

Rising inflation is forcing many families to spend more on their cards. If you are carrying credit card debt, you are not alone. According to an annual survey conducted by Bankrate, 1.3 of Americans (36%) have more credit card debt than emergency savings, marking the highest figure recorded in over a decade of polling.

Another survey by Bankrate reveals that approximately 50% of all credit card holders now maintain balances from month to month, a notable increase from 39% in 2021. TransUnion reports that the average borrower currently holds $6,360 in credit card debt, reaching an all-time high.

Delinquency Rates on Credit Cards

Along with a rise in credit card debt, the number of Americans missing payments is also increasing. In February 2024, the St. Louis Federal Reserve of Economic Data, or FRED, released its credit card delinquency report. The report shows that delinquency rates rose above 3% for the fourth quarter of 2023, the highest rate since 2011.

The delinquencies are highest among those with lower incomes, millennials, and people who hold other kinds of debt, such as car and student loans.

Interest Rates on Credit Cards are Way Up

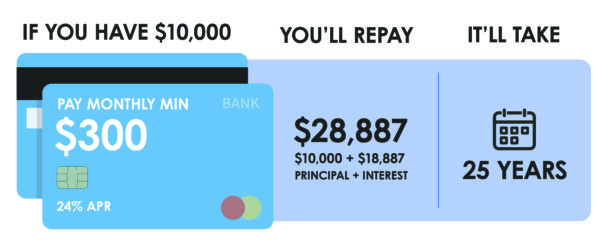

When the Federal Reserve raises interest rates, it often leads to an increase in credit card interest rates. Credit card issuers adjust their rates in response to the higher borrowing costs set by the central bank. According to Forbes, the average credit card interest rate is above 27%. Twenty-Seven…Percent!

So, if you carry a balance of $10,000, it will cost you $2,700 per year! A higher interest rate means a higher monthly payment is needed to stay current. Many cardholders are unaware of how much interest they are paying or how long it could potentially take to pay off the balance with minimum payments.

What Can You Do About It

If you’re a homeowner, then you’re in luck. Home prices have gone up dramatically, and there is a record amount of equity in homes. While credit card debt sits at an average of 27%, average mortgage rates are 6.5% for a first mortgage and 9.5% for a second mortgage.

Why a Debt Consolidation Mortgage Saves You Money

A good mortgage lender can help you consolidate your credit card debt into an equity mortgage to help you save money. Let’s break down an example below:

$50,000 in credit card debt = a required monthly payment of $1500 per month.

The same $50,000 would carry a payment of $338 as of today at a rate of 6.5%.

The difference is due to the rate difference of 6.5% vs 27%.

You can get an idea of how to run the numbers yourself and see how much you can save here.

Further, if you consolidate the credit cards into a mortgage, the rate is usually fixed, while credit cards have a variable rate. It’s also important to remember that while 6% seems higher for a mortgage, you can also refinance that loan when rates drop.

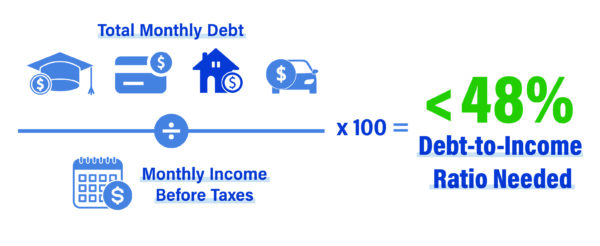

How to qualify for a debt consolidation mortgage.

If you’re thinking about getting a debt consolidation mortgage, there are a few things to keep in mind.

Keep your credit score above 600.

Have equity in your home, more than 20%.

DO EVERYTHING YOU CAN TO AVOID MAKING PAYMENTS LATER THAN 30 DAYS AFTER THE DUE DATE!

Have enough provable income to support your new debt to income.

An exceptional lender will boast numerous reviews highlighting their outstanding service. These reviews should appear genuine and authentic, reflecting a long-standing history of feedback from real clients.

For instance, you can explore Homestead’s Google reviews for firsthand accounts. Additionally, conducting a search for specific lenders on platforms like Zillow can provide valuable insights from previous customers. Delving into others’ experiences with a lender can offer valuable guidance on what to expect from your own interaction.

When you are ready, reach out! Our team is happy to communicate with you in whatever way you prefer. We can discuss your situation and options via email, text, or phone call.

Higher interest rates, late payments on the rise, and higher amounts of debt all point to the strain and stress on many household budgets. There are options like debt consolidation and equity financing. Before you miss any payments, talk to us today – if you fall late, you may have waited too long to qualify.