Written by:

Doug Shoemaker – Branch Manager O’Fallon, IL – (618) 795-0790

Doug Shoemaker – Branch Manager O’Fallon, IL – (618) 795-0790

A commonly misunderstood and confusing topic for homeowners in Illinois is Illinois tax bills. Understanding these tax bills is crucial to ensure a smooth homebuying process and to ensure no surprises come at closing or in the years to come when you receive your tax bill. We will cover some of the complexities of tax bills in Illinois and provide you with the knowledge you need to navigate them effectively.

The Basics of Tax Bills in Illinois

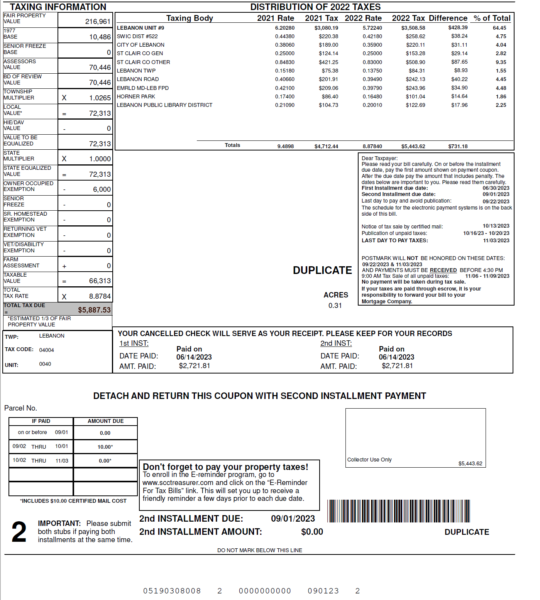

A tax bill refers to a financial document that outlines the amount of tax owed by homeowners for the ownership or possession of a residential property. This bill typically includes details such as the assessed value of the house, applicable tax rates, and any deductions or exemptions that may apply. The tax amount is usually calculated based on factors like the property’s value, location, and local tax regulations. Tax bills are essential to local government revenue generation and are used to fund various public services and infrastructure projects. Homeowners are typically responsible for paying these taxes annually or in installments, as mandated by local tax authorities.

When you purchase a home in Illinois, the county assigns it a fair property value, which determines the annual real estate taxes. If you don’t have your exact tax bill or a specific property in mind, you can estimate the taxes using 2.2% of the purchase price for Illinois.

The Local and Equalized Value

In Illinois, the local value is typically around one-third of the fair property value. However, exemptions are applied to the equalized assessed value, not the tax bill itself. This distinction is important to keep in mind. The Equalized value is figured by taking the assessor’s value and multiplying that by the township multiplier, then multiplying that by the state multiplier.

Understanding Exemptions

Exemptions play a significant role in reducing your tax burden. For example, if you plan to live in the home as your primary residence, you qualify for an owner-occupied exemption, also known as the homestead exemption. This exemption is typically around $6,000. There are additional exemptions for senior citizens, disabled veterans, and many more you can read about here.

An Example Calculation

Let’s walk through an example to solidify your understanding. Suppose you’re purchasing a home with a fair property value of $216,961. For simplicity, we’ll use the same value for this calculation. The assessed value is $70,446; after applying the township and state multiplier, the equalized value is $72,313.

Factoring in Exemptions

Since this is an owner-occupied property, we can reduce the equalized assessed value by $6,000, thanks to the homestead exemption. Multiplying this adjusted value by the tax rate (8.87845%) gives us the annual real estate tax amount. However, additional exemptions may exist, but to be careful in estimating taxes, we’ll go with the basics to estimate taxes so there are no surprises at closing.

The Importance of Working with a Hyper-Local Lender

Understanding tax bills can be overwhelming, especially for out-of-state lenders. That’s why working with a hyper-local lender like us is crucial. We know the exemptions you can qualify for and will talk to you about them before applying for your loan so that you can know to apply for them and have those exemptions built into your loan. At Homestead Financial Mortgage, we have the knowledge and experience to guide you through the process, ensuring you fully comprehend the implications of tax bills on your loan approval and monthly payments.

Applying for Exemptions

Remember, you must apply for these exemptions; some require annual reapplication. Failure to do so can result in losing the exemption and paying higher taxes. At our Homestead Financial Mortgage, we prioritize educating our clients about these requirements and providing timely reminders throughout the year.

We’re Here to Help

If you still have questions or find tax bills confusing, you are not alone. We’re here to help. Whether you’re considering buying a home or know someone who is, working with a local team that genuinely cares about their clients’ understanding and well-being is essential. Our team at Homestead Financial Mortgage believes in an honest, education-based process that combines the latest technology with a personal touch. We’re here to support you when you’re ready.

To schedule a no-stress, no-obligation strategy session, simply let us know. We will guide you through the intricacies of tax bills and ensure a smooth homebuying process.