Tackling the Homebuyer Affordability Crisis | Part 3 of 4

This article focuses on first-time homebuyers planning to purchase within the next five years. We’ve previously covered what the timeline looks like when you’re thinking about buying within a year. Having a longer timeline creates more flexibility and allows buyers to strengthen their overall financial profile before entering the market. Using the same Four C’s framework as introduced earlier in this series, this article outlines how longer-term preparation can expand options and improve affordability.

Credit: Building Toward a Stronger Qualification

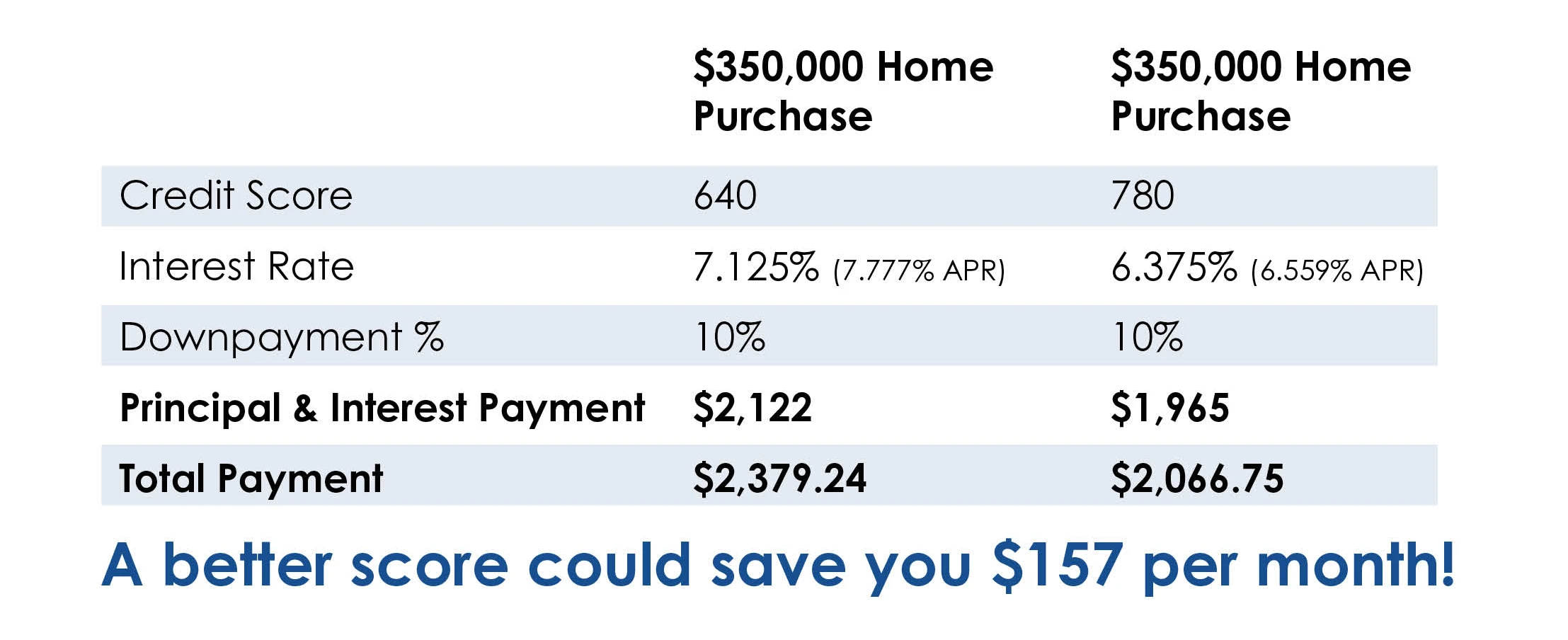

For buyers with several years to prepare, credit improvement can significantly impact loan options and interest rates. While many loan programs allow financing with scores above 620, higher credit scores generally result in better pricing. Mortgage rate tiers often improve in incremental ranges, meaning gradual improvements can still provide measurable benefits.

The information provided by Homestead Financial Mortgage is for educational purposes only. Products and interest rates are subject to change at any time due to fluctuating market conditions. Actual rates available may vary based on a number of factors, including credit rating, down payment, loan type, and documentation provided. Homestead Financial Mortgage is an equal housing lender.

Over a longer timeline, buyers can focus on consistent on-time payments, managing credit card balances relative to limits, and establishing a healthy mix of credit. Buyers with questions about credit strategy or improvement timelines should seek guidance before making changes that could have unintended effects.

Capacity: Establishing Stable Income History

Capacity evaluates a borrower’s ability to repay the loan based on income and existing debts. A two-year history in the same job or career field is a common guideline, with flexibility for job changes within the same industry.

For buyers still in school, a completed degree, along with employment in the field of study, may be used to satisfy employment history requirements once work begins. Buyers with variable income, such as commission, bonus, or self-employment income, typically need a full two-year documented history for that income to be considered qualifying.

Lenders evaluate affordability using debt-to-income ratios, or DTI, which compare monthly debt obligations to gross monthly income. The front-end DTI looks only at the estimated mortgage payment, while the back-end DTI includes the mortgage payment plus other recurring debts such as car loans, student loans, and credit cards. As a general guideline, front-end DTI should remain at or below 33 percent, while back-end DTI is typically capped at around 45 percent. Staying within these ranges helps preserve loan options and affordability as buyers prepare to purchase.

A longer planning horizon gives buyers time to stabilize income, reduce debt, and improve debt-to-income ratios before purchasing.

Capital: Preparing for Down Payment and Closing Costs

Buyers planning to purchase in five years have more opportunity to accumulate funds for a down payment and closing costs. Depending on the loan program, down payments may range from approximately 3.5 percent to 5 percent or more.

Funds may come from savings, documented gift sources, or loans against retirement accounts such as a 401(k). While down payment assistance programs may be available, buyers with more time to prepare often benefit from building their own reserves, as stronger capital positions can improve competitiveness when making offers.

Veterans and eligible rural buyers may qualify for loan programs that allow 100% financing, though eligibility varies by location and service history.

Collateral: Expanding Property Options Over Time

With a longer planning window, buyers may have greater flexibility when considering property types. Common options include owner-occupied single-family homes, condominiums, townhomes, and two to four-unit residential properties where the buyer occupies one unit.

Some buyers use this additional time to prepare strategies, such as purchasing a multi-unit property and renting out the remaining units to help offset housing costs. While this approach can improve long-term affordability, it may involve higher purchase prices, additional qualification requirements, and stricter property standards.

Regardless of property type, lenders evaluate condition, occupancy, and marketability. Many first-time homebuyer loan programs require properties to meet specific safety and habitability standards. Buyers with more time to plan can be more selective and better prepared to align property choices with financing options.

Long-Term Preparation Considerations

A longer timeline allows buyers to approach homeownership strategically. Reviewing credit reports periodically, contributing consistently to savings or retirement accounts, and building a stable employment history can all support future qualification. Working with experienced real estate and mortgage professionals early in the process can help buyers understand benchmarks and adjust plans as needed. While waiting may be the best option for some, others may benefit from buying sooner rather than later. An experienced loan advisor can help you determine what makes the most financial sense for your situation.