Jayson Hardie – Managing Partner – (636) 256-5712

Jayson Hardie – Managing Partner – (636) 256-5712

I recently had the chance to speak with a group of real estate investors—sharp, driven individuals focused on scaling their portfolios. I was there to share insights on the current mortgage landscape and highlight what they should keep an eye on from a financing standpoint.

During the Q&A, we covered everything from process-related questions to some very specific one-off scenarios.

Then came the question: “When do you think mortgage rates are coming down?”

So, here’s the thing—mortgage rates aren’t coming down to the 2s… or even the 3s… ever.

Okay, maybe if there’s a full-blown financial apocalypse. But short of that? It’s not happening.

I gave my usual go-to line — “We don’t have a mortgage rate crystal ball”— but I quickly realized that wasn’t really what they were asking. With a little back-and-forth, it became clear they meant: “When are rates coming back down to those sweet, sweet COVID-era lows?”

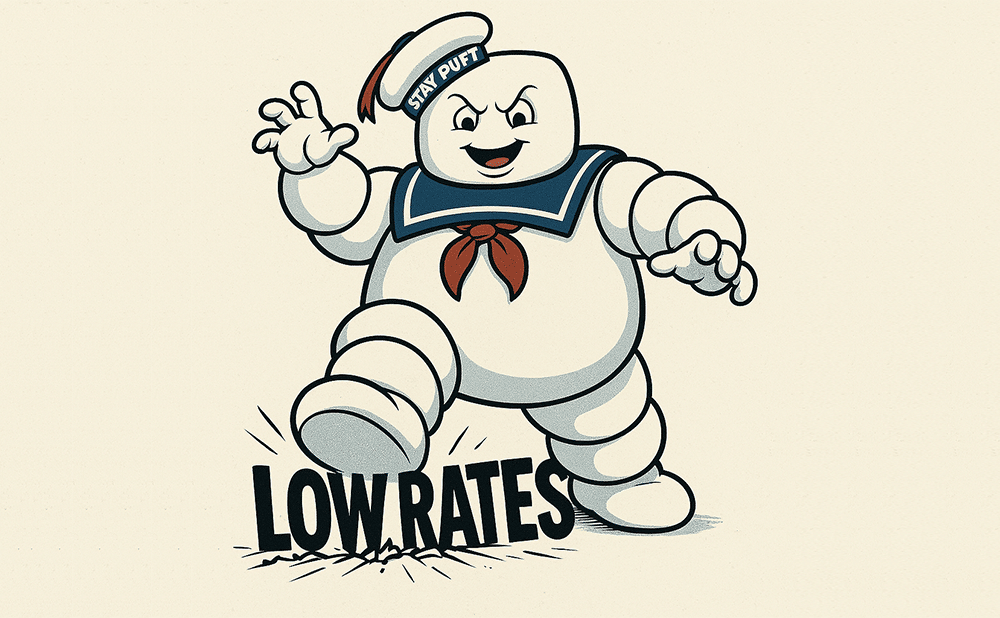

Meanwhile, in the back of my mind, one of my internal subroutines morphed into a dream-crushing monster. Picture the Stay-Puft Marshmallow Man—you know, the fictional character from Ghostbusters—but with less fluff and way more economic reality. I knew I was about to stomp on some hopes.

So, I gave it to them straight: “They’re not coming back to the COVID range—ever.”

The silence that followed said it all. I had struck a nerve. But here’s the thing—there’s a real reason why those ultra-low rates are behind us, and it has everything to do with how the economy has changed.

Government Buying Mortgage-Backed Securities

In March 2020, the Federal Reserve began purchasing mortgage-backed securities (MBS) to help stabilize financial markets during the early days of the COVID-19 pandemic. These purchases continued through June 2021, during which the Fed’s holdings of agency MBS grew from $1.4 trillion to $2.3 trillion.

Why was this necessary? Because in a normal market, very few investors would be interested in buying securities that yield just 2.5%. Without the Fed’s intervention, there simply wouldn’t have been enough demand to support those ultra-low mortgage rates.

We Have the Opposite Problem Now

During COVID, the U.S. government took aggressive steps to prevent the economy from grinding to a halt. Stimulus checks, ultra-low interest rates, and Federal Reserve intervention were all designed to keep money flowing and avoid a deflationary spiral. At the time, the primary concern was deflation—falling prices and reduced demand—which could have deepened the economic downturn.

Today, we’re dealing with the opposite issue: the economy is running hot. Inflation, not deflation, is now the main challenge. Strong consumer spending, a tight labor market, and lingering supply chain issues have all contributed to persistent upward pressure on prices.

Adding to the complexity, recent tariff policies could further affect the economic landscape. Tariffs on imported goods may protect domestic industries, but they also tend to raise prices for consumers and businesses alike—potentially making inflation worse. In a time when the Federal Reserve is trying to cool inflation without stalling growth, added cost pressures from trade policy only make that balancing act harder.

Inflation Will Continue to Be a Challenge for Global Reasons

China is facing a major demographic shift that could reshape its position in the global economy. Once the most populous country in the world, China has now ceded that title to India. Its population is not only shrinking but also aging rapidly, leading to a declining labor force and growing concerns about long-term productivity.

According to a study cited by CNBC, China is expected to lose up to 30% of its manufacturing capacity over the next five years. This shift is driven by rising labor costs, changing global supply chains, and ongoing geopolitical tensions. As a result, many companies are diversifying production and moving operations to countries like Vietnam, India, and Mexico to reduce dependence on China.

These shifts will have far-reaching impacts—affecting global trade, product pricing, and the availability of goods. While these transitions create opportunity, they also come with growing pains, especially in terms of cost and logistics.

What Is Onshoring—and Could It Help?

One trend that could help ease inflation—and eventually support lower mortgage rates—is the rise of onshoring. Onshoring refers to the practice of bringing production and manufacturing back to the U.S. (or closer to home), as opposed to offshoring, where companies move operations overseas to cut costs.

As companies relocate operations back to the U.S. or nearby countries, they reduce reliance on the complex global supply chains that proved vulnerable during the pandemic. More localized production helps lower transportation costs, reduce delays, and minimize price volatility. Over time, this added stability can help ease inflation.

Because inflation is one of the biggest factors driving interest rate policy, a more stable and efficient supply chain environment could support the Fed’s long-term efforts to bring rates back down. That said, this won’t happen overnight—or cheaply. Much of the manufacturing infrastructure returning from China to the U.S. will require massive investment, and that investment is contributing to rising costs across the board.

When Will Things Slow Down?

One factor that could reshape the economic and housing landscape is the aging Baby Boomer generation. As more Boomers retire, downsize, or tap into their home equity for retirement income, we may start to see a rise in housing inventory and shifting demand patterns.

However, with Millennials and Gen Z continuing to enter the housing market in strong numbers, overall demand remains resilient. This generational push-pull—more homes potentially coming onto the market while younger buyers compete for them—will create interesting dynamics in the years ahead.

Combined with global supply shifts and stubborn inflation, this means mortgage rates are likely to stay elevated in the near term, even as economic growth starts to slow.

The Takeaway on Rates and Real Estate Investment

Even with higher mortgage rates, buying a home is still one of the smartest long-term investments you can make. While rates may affect monthly payments today, real estate continues to build wealth over time through appreciation and equity growth.

Rents are also rising, which makes homeownership a more stable and predictable financial option. And here’s the thing: you can always refinance if and when rates come down—but you can’t go back in time and buy at today’s prices.

In a market where demand still exceeds supply, especially for entry-level and move-in-ready homes, getting in sooner rather than later is often the wiser move.