Tackling the Homebuyer Affordability Crisis | Part 2 of 4

This article focuses on first-time homebuyers planning to purchase within the next 12 months. Buyers in this timeframe are typically balancing urgency with preparation, whether due to growing families, relocation needs, or expiring rental situations. The goal in this stage is to know what to focus on to be prepared, using the same four C’s framework introduced in Part 1: Credit, Capacity, Capital, and Collateral.

Credit: Establishing Mortgage Readiness

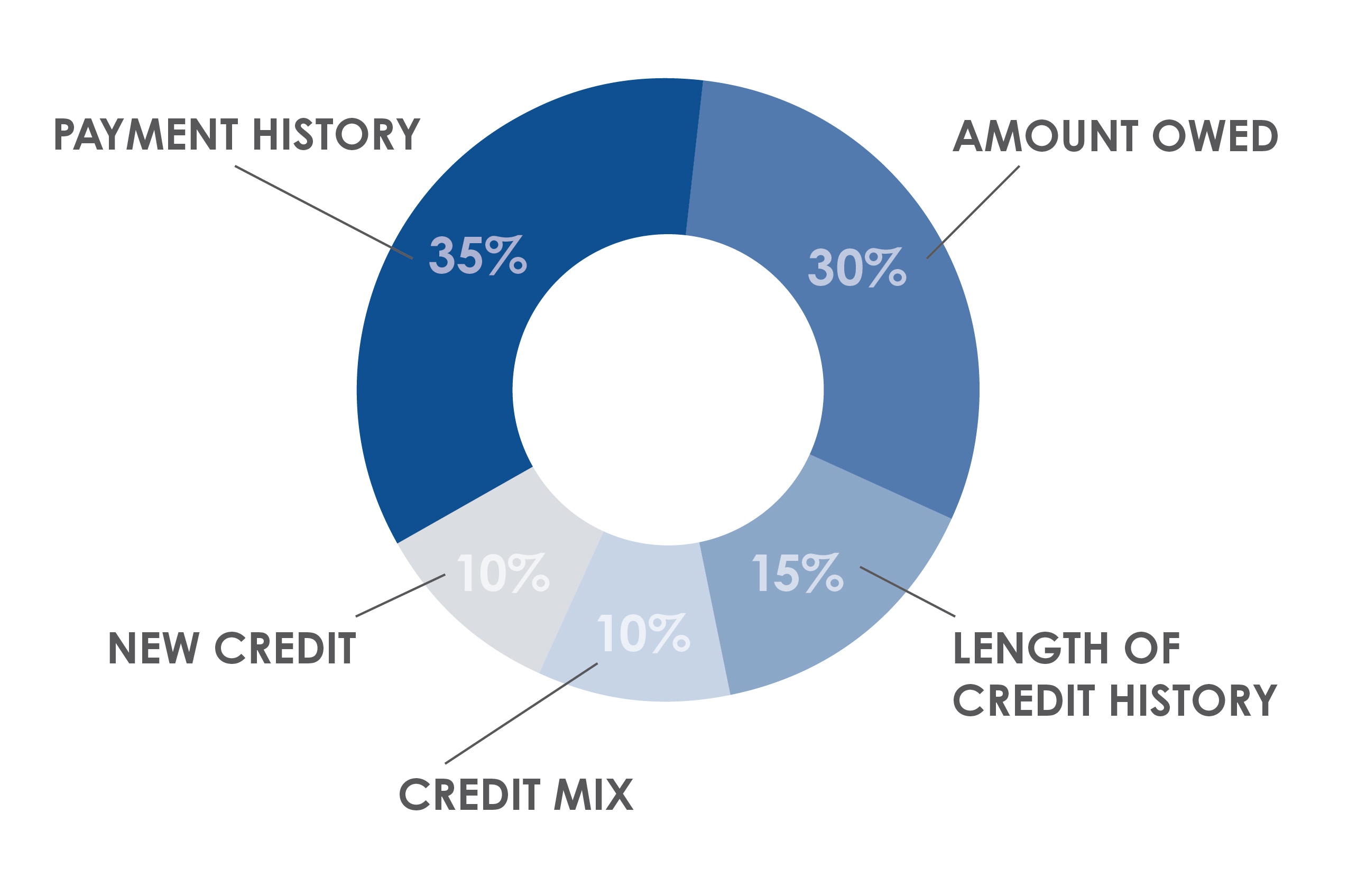

For buyers planning to purchase within the next year, a credit score of 620 or higher is a common minimum requirement for many loan programs. Higher scores may improve available options and overall affordability.

Beyond the score itself, lenders review how credit is managed. Consistent on-time payments and maintaining lower balances relative to credit limits can positively impact credit profiles. Buyers with existing collections should avoid making changes unless advised by a mortgage professional, as paying off older collections can sometimes result in short-term score decreases.

Because credit strategies vary by situation, buyers close to purchasing should seek guidance before making adjustments.

Capacity: Verifying Income Stability

Capacity focuses on a borrower’s ability to repay the loan based on income and existing debt obligations. A two-year history in the same job or career field is a common guideline, though recent job changes may be acceptable when they are within the same line of work.

For buyers graduating from college with employment secured within their field of study, education may be used to satisfy employment history requirements, allowing qualification shortly after starting the new position.

Buyers with commission-based income typically need additional documentation or a longer earnings track record. Because guidelines vary by loan program and income structure, this is an important topic to review with your loan advisor early in the planning process.

As reviewed in Part 1, lenders assess capacity using debt-to-income ratios to ensure the mortgage payment fits within established affordability guidelines.

Capital: Funds Needed to Purchase

Buyers purchasing within the next year typically need access to funds for a down payment and closing costs. Depending on the loan program, down payments may range from approximately 3.5 to 5 percent.

Acceptable sources of funds may include personal savings, documented gift funds from eligible relatives, or loans against retirement accounts such as a 401(k). Some buyers may also qualify for down payment assistance programs, which often require a reduced upfront contribution. Veterans and eligible rural buyers may qualify for loan programs that allow 100 percent financing.

There may be tax and documentation considerations when using gifted funds toward a home purchase. Buyers using gift money, including funds received for special occasions, should understand what information lenders require to properly document these funds.

Understanding which options apply requires a personalized review, even when buyers are uncertain that they meet all criteria.

Collateral: Choosing the Right Property

For buyers planning to purchase within the next year, property selection plays a big role in both loan approval and long-term affordability. Because the home serves as collateral for the mortgage, lenders evaluate not only the buyer’s qualifications but also the type, condition, and intended use of the property.

Most first-time buyers in this timeframe focus on owner-occupied properties such as single-family homes, condominiums, and townhomes. These property types generally offer the widest range of financing options and more predictable approval timelines.

Some buyers may also consider multi-unit residential properties, where the buyer occupies one unit and rents out the others. This approach, often referred to as house hacking, can help offset monthly housing costs by generating rental income. While this strategy can improve affordability, multi-unit properties come with additional considerations, including higher purchase prices and stricter loan requirements.

Regardless of property type, lenders review factors such as property condition, occupancy requirements, and marketability. Many first-time homebuyer loan programs, including FHA financing, require properties to meet specific safety and habitability standards. Homes that need significant repairs or do not meet these guidelines may limit financing options or delay closing. Buyers purchasing within the next year are often best served by focusing on properties that meet common loan standards and support a smooth approval process.

Key Considerations for Buyers on a Short Timeline

Buyers planning to purchase soon should focus on strategies that improve affordability and flexibility. Market conditions, including interest rates, can change, but purchase timing should be based on readiness rather than waiting for the ‘right rate’ to come along. In many cases, refinancing options may be available later if rates decline.

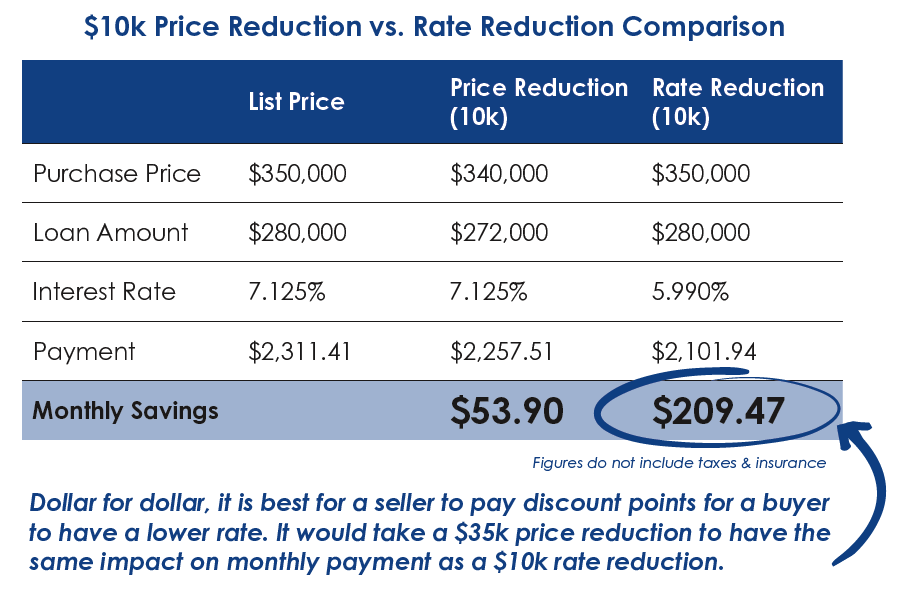

Seller concessions can also play an important role. In some transactions, seller-paid costs used to reduce a buyer’s interest rate can have a greater impact on monthly payments than a price reduction. Additionally, qualified non-occupant co-borrowers, such as relatives, may help strengthen income qualifications in certain situations.

This comparison is based on a 701 credit score, 20% down payment, 30-year term, 7.125% interest rate with an APR of 7.238%, and a 5.990% interest rate with an APR of 6.362%. The information provided by Homestead Financial Mortgage is for educational purposes only. Products and interest rates are subject to change at any time due to fluctuating market conditions. Actual rates available may vary based on a number of factors, including credit rating, down payment, loan type, and documentation provided.

Finally, working with experienced real estate and mortgage professionals can help buyers navigate negotiations, financing options, and timelines more effectively, especially when purchasing within a compressed timeframe.