When you’re asking yourself, “Should I buy or rent?” there are three significant advantages of purchasing to consider.

The first one is payment stability.

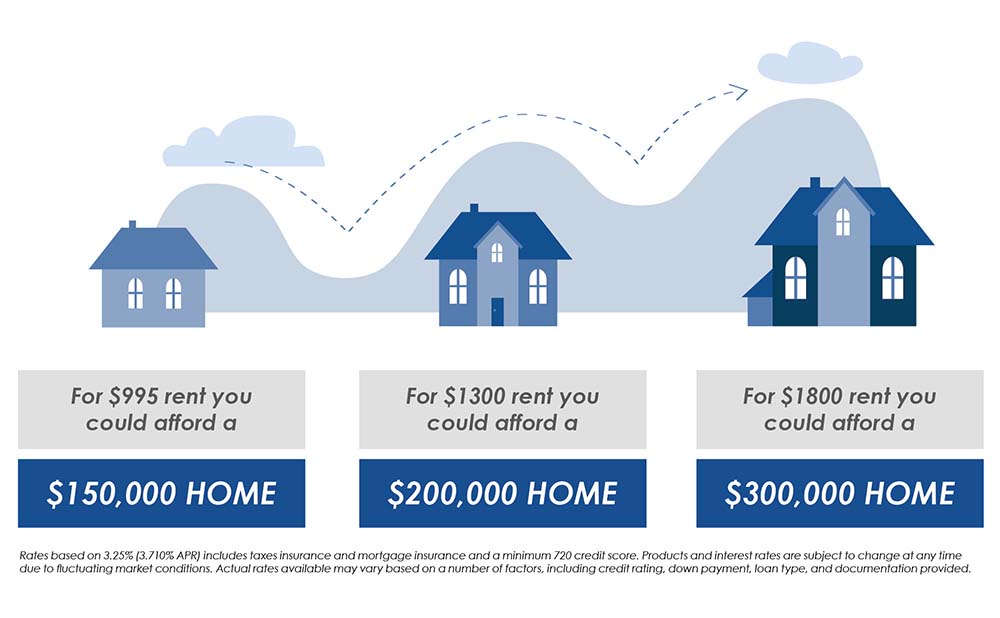

As a renter, you probably have very little control over your rent being increased year after year. Rather than paying more for rent, consider buying instead. Even if your first property is a condo or smaller home, you might be surprised at how affordable purchasing is. When you’re paying a mortgage instead of rent, you’ll have much more control over your budget. You’ll know what your payment will be month after month, year after year.

Tax Advantages.

Another thing that will help your budget are the significant tax advantages you’ll have when you’re a homeowner. With homeownership, you’ll save money because of tax write-offs instead of giving it away to Uncle Sam.

Pride of Ownership.

And possibly the most enjoyable factor when comparing the rent vs. buy calculation is the “Pride of Ownership”. There’s a big difference between decorating a home you’re renting versus one you own. When you own your home, you’re the boss. If you want to paint a room or hang pictures, there’s no problem. You don’t have to ask permission. Plus, every improvement you make will go towards increasing your equity.