Jayson Hardie – Managing Partner – (636) 256-5712

Jayson Hardie – Managing Partner – (636) 256-5712

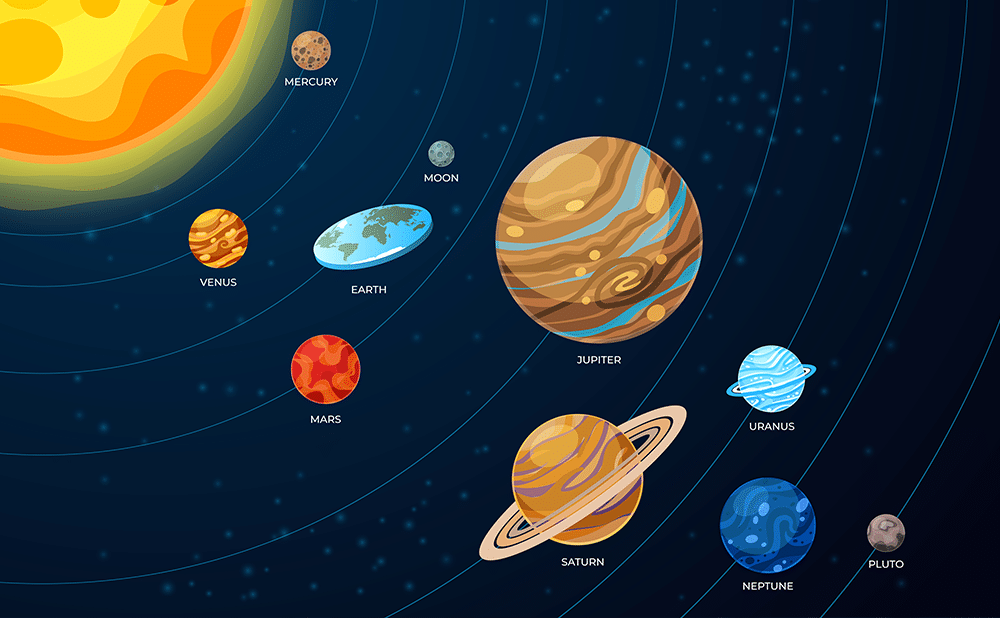

The Earth is flat.

You need 20% down to buy a home.

You must have perfect credit to get approved for a mortgage.

Never let anyone pull your credit more than once while shopping for a loan.

A finished basement counts toward your home’s square footage.

These are all stubborn myths that just won’t die. Let’s bust them!

The Original Myth-Buster: Eratosthenes

Back in 240 B.C., Eratosthenes proved the Earth was round using little more than a stick, a shadow, and some clever math. Yet, the flat-Earth theory stuck around for another 1,500 years after that, persisting well past Columbus’ voyage.

Even today, despite photos from space, time zones, and countless other proofs, there are people who still cling to the flat-Earth idea. (Yes, they even have their own website: The Flat Earth Society).

Real estate has its own “flat Earth” myths, ideas that have been disproven but somehow keep getting passed around. Let’s break down a few of the most common.

Myth #1: You Need 20% Down to Buy a Home

This is one of the most persistent myths in real estate, and it keeps a lot of people from even starting the home-buying process.

While a 20% down payment can help you avoid private mortgage insurance (PMI), it is far from a requirement across the board. In reality, there are plenty of options for buyers with much smaller down payments:

- FHA loans – As low as 3.5% down for qualifying buyers.

- VA loans – 0% down for eligible Veterans, active-duty service members, and certain military spouses.

- USDA loans – 0% down for qualifying rural and suburban homebuyers.

- Conventional loans – Many allow down payments as low as 3%.

On top of that, state and local grants, such as the MHDC program, and down payment assistance programs can reduce your out-of-pocket cost even further, sometimes covering most, if not all, of your required down payment.

The bottom line here is that waiting until you have saved 20% could delay your homeownership dreams by years when you might already qualify to buy now.

Myth #2: A Finished Basement Counts as Square Footage

Nope. While a finished basement can absolutely add value to your home, it does not increase your official square footage.

Example: You have a 2,500 sq. ft. ranch with a 2,500 sq. ft. unfinished basement, purchased for $250,000. In a nearby neighborhood, a 5,000 sq. ft. ranch sells for $750,000.

If you finish your entire basement, your home is still considered 2,500 sq. ft. You cannot compare it to the 5,000 sq. ft. home in value. This applies whether it is a walk-out basement or a basement with bedrooms.

Myth #3: You Need Great Credit to Buy a Home

Not true. Let’s define “great” first. The average U.S. credit score is around 690, while “great” credit is generally considered 740 or higher. This means the majority of buyers fall somewhere below the “great” range, and that is completely normal. Many successful homeowners started with credit scores in the “fair” or “good” range and still qualified for financing.

You can get approved for a mortgage with a score as low as 580. You may need to offset a lower score with a more substantial income or a larger down payment, but buying a home is still possible.

If you want to improve your credit score, start by understanding what goes into it. Secured credit cards, for example, can be a helpful tool for building or repairing credit over time. While having a “great” score can offer some advantages when buying a home, don’t let a lower score hold you back. You can purchase now and refinance later when you’ve had a chance to build your credit score and secure a lower interest rate and better terms.

Myth #4: Don’t Pull Your Credit More Than Once When Mortgage Shopping

This one causes a lot of unnecessary stress. Here is the truth:

Yes, a single credit pull can drop your score by about 5–8 points. But if you are shopping for a mortgage, multiple inquiries within a short window (in the same industry) count as one pull for scoring purposes.

In other words, shop around! Mortgage lenders expect you to compare offers, and credit scoring models allow for it. Don’t be afraid to learn where you stand when it comes to getting a mortgage, getting pre-approved, and seeing what you can afford. This should be the first step you take when considering buying a home.

The Bottom Line

Just like the Earth is not flat, these real estate “facts” are not facts at all. The best way to navigate homebuying is with good information, not outdated myths.

If you hear something that sounds questionable, ask a trusted real estate or mortgage professional before you accept it as the truth.