Jayson Hardie – Managing Partner – (636) 256-5712

Jayson Hardie – Managing Partner – (636) 256-5712

Somewhere, my Japanese mother is rolling over in her grave.

Growing up, a college degree was as non-negotiable as getting straight A’s. It was an expectation and the key to a good life. The value of investing in a college education was considered absolute.

Sorry, Mom. In 2025, I no longer believe a college degree is the best bet for everyone, especially for those hoping to buy a home or build long-term financial security.

As a mortgage lender, I review credit reports every day. I’ve seen countless applicants burdened with tens or even hundreds of thousands of dollars in student loan debt. What’s most shocking is when the income from their chosen career doesn’t come close to justifying the cost of that education. The first major investment most people make —their college education —can turn out to be either the best or the worst investment of their lives.

A common example is a student who attends a private university, finances the entire cost through student loans, and earns a degree in “basket weaving.” They graduate, land a $40,000-a-year job, and wonder where it all went wrong.

(Note: “Basket weaving” here is simply a metaphor for a college degree with potentially little market demand, not a jab at any real field of study.)

Viewing College Like an Investment

A college degree can still be a great investment. It can also be the single worst one you make, and your financial life will reflect the quality of that decision. That’s why higher education should be viewed the same way as investing in the stock market. Before you enroll, ask yourself:

- How much will I have to invest?

- What’s my expected return on investment (ROI)?

- How much debt will I need to take on?

- What other personal factors should I consider?

Let’s break those down.

1. How Much Will You Have to Invest?

In Missouri, the average in-state tuition is about $10,000 per year. Add roughly $15,000 per year for room and board, and you’re looking at $25,000 to $35,000 annually. Over four years, that’s around $140,000 total before factoring in books, fees, or living expenses.

That’s your initial investment, the amount of money or debt you’ll spend in hopes of future returns.

If you choose to go out of state, that cost can increase significantly. Out-of-state tuition or private school tuition often doubles or even triples, depending on the university, easily pushing the total investment above $200,000. This is one reason many students work hard to earn scholarships, grants, or work-study opportunities, since those can dramatically lower the cost of education and improve financial stability after graduation.

Even so, the question remains: Will your investment in that “basket weaving” degree pay off once you enter the job market?

2. What’s the Expected Return on Investment (ROI)?

Your return on investment (ROI) is the financial gain you receive compared to what you spent to achieve it. In education, it’s your future income versus the total cost of your degree.

If you spend $140,000 on a basket weaving degree and the average salary in that field is $40,000 per year, your ROI is low. You’ve spent a large amount for a modest financial return. Unfortunately, many universities still “sell” degrees with limited job prospects, and few students are guided to evaluate that risk beforehand.

When viewed from an investor’s perspective, it’s like putting your entire savings into a stock that pays a small dividend. You may love the company, but it’s not a sound financial move.

3. How Much Debt Will You Need to Take On?

If your parents can’t help pay for school, you’ll likely finance your education through student loans. Financing means using borrowed money to pay for something you can’t afford upfront, with the expectation that you’ll repay it over time, plus interest.

Let’s revisit our “basket weaving” example. You’ve borrowed $140,000 at a 6% interest rate. That means you’ll accrue about $8,400 per year in interest after graduation. If your job pays $40,000 annually, that interest alone consumes more than 20% of your income before you’ve paid for housing, food, or other expenses.

Now, consider repayment. Most federal student loans use a 10-year repayment plan. A $140,000 loan at 6% would mean monthly payments of roughly $1,550. On a $40,000 salary, that’s nearly half your take-home pay after taxes. Many borrowers extend repayment to 20 or even 25 years to lower monthly costs, but that dramatically increases total interest paid, often exceeding $200,000 over time. This is the kind of debt that can take a lifetime to repay and feel crushing to a borrower.

This level of debt has another major consequence: it affects your debt-to-income ratio, which plays a key role in your ability to qualify for a mortgage.

Debt-to-Income Ratio (DTI) measures how much of your monthly income goes toward debt payments. It’s calculated by dividing your total monthly debt, such as student loans, car loans, and credit cards, by your gross monthly income.

For example, if you make $3,333 per month and have $1,550 in student loan payments, your DTI is 46%. Most mortgage lenders prefer a DTI below 43%. A higher ratio tells lenders that too much of your income is already tied up in debt, which makes you a higher lending risk.

A high DTI can:

- Make it harder to qualify for a mortgage or personal loan.

- Reduce the amount you can borrow, limiting your home-buying budget.

- Lead to higher interest rates or less favorable loan terms.

In other words, large student loan debt doesn’t just delay homeownership. It can actively prevent it. Even if you’re making steady payments, your DTI can hold you back from achieving other financial goals.

4. What Other Factors Should You Evaluate?

Money matters, but so does fulfillment. The ideal career offers both financial stability and personal satisfaction. Before choosing a degree, ask yourself:

- Do I enjoy the work this degree prepares me for?

- Does it pay enough to sustain the lifestyle I want?

- Could I achieve similar outcomes through trade school, certifications, or apprenticeships that require less debt?

Maybe “basket weaving” makes your heart happy, but could you teach art or design instead, where there’s a stronger job market and higher pay? Sometimes, the right compromise leads to both passion and profit.

Helping the Next Generation Make Smarter Choices

One of the best ways to help high school students make informed decisions about their education is to give them opportunities to explore the real world before committing to a degree. Encouraging students to job shadow, intern, or volunteer in fields that interest them can provide invaluable insight into what a career actually looks like day to day.

Schools, parents, and community organizations can also connect students with mentorship programs, career exploration workshops, or trade school open houses to help them see all the options available, not just the traditional four-year path. By giving young people early hands-on exposure to different industries, we empower them to align their interests with realistic earning potential and long-term goals. The result is smarter choices, stronger financial outcomes, and a generation better prepared to build successful, sustainable futures.

Conclusion

The goal for all of us is a good life, one that’s emotionally fulfilling and financially secure. To get there, we must invest our most valuable asset —time —wisely. Your education should empower you, not trap you in debt.

Balance what you love doing with what can support you financially, and make sure the price of your education makes sense for the life you want to build.

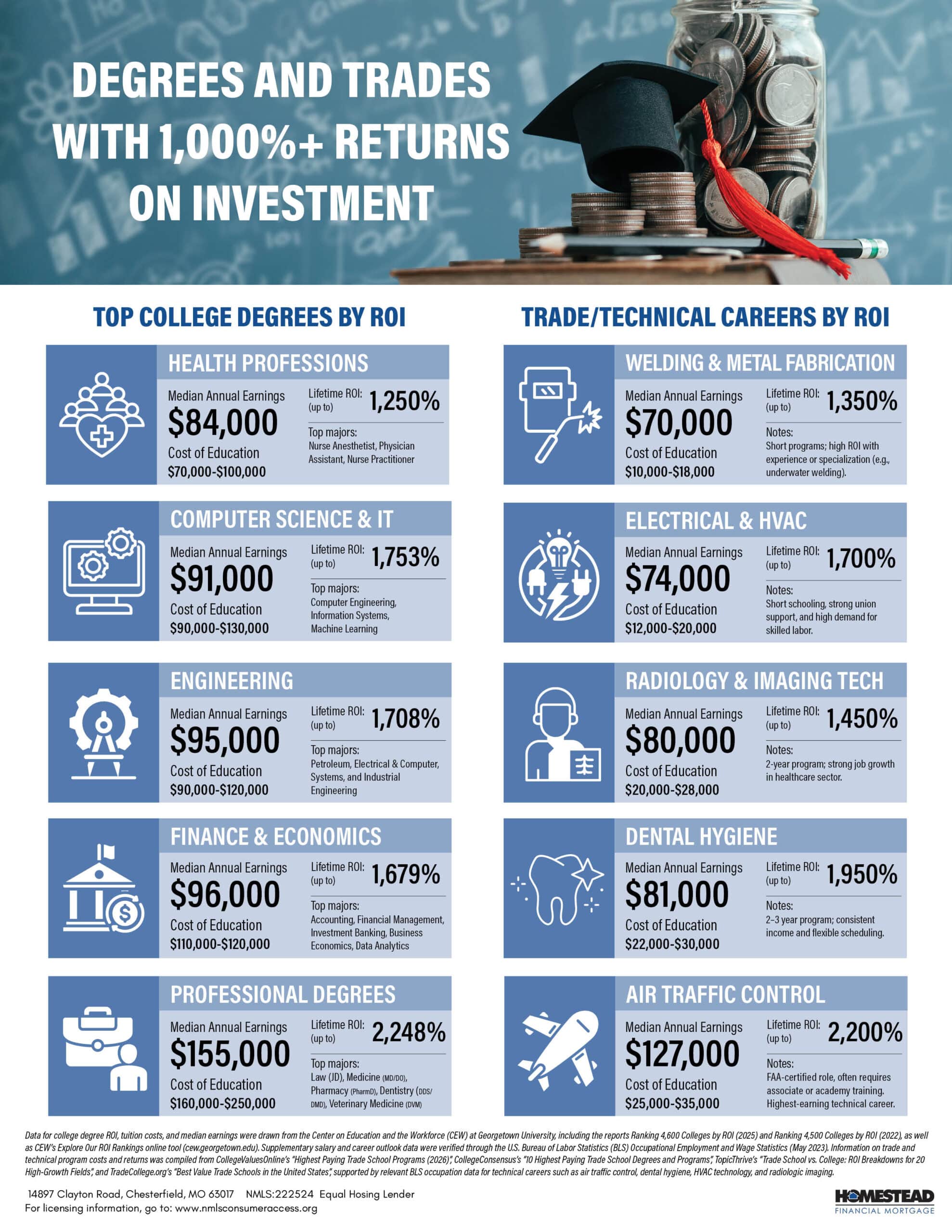

Check out this helpful infographic to compare some of the top college degrees to top trade school and technical degrees.