Starting the journey toward homeownership comes with plenty of paperwork, and one of the most important documents you will see early on is the Loan Estimate (LE). This three-page form, required by law, lays out the essential details of your potential mortgage in a clear and standardized format. It is designed to help you compare offers from different lenders and understand what your loan will really cost over time.

But simply receiving a Loan Estimate is not enough. You need to know how to read it and what to focus on so you can make the best decision for your budget and long-term goals.

Where the Loan Estimate Fits in the Mortgage Process

Here is a quick look at when and how you will receive a Loan Estimate:

- Pre-Approval: The process usually begins with getting pre-approved. This involves submitting a loan application with your financial details such as income, credit, and assets. During this stage, your lender can provide you with a sample Loan Estimate. This version is not final but gives you an idea of estimated costs and rates based on what you qualify for. It helps you understand your budget and what type of loan programs may be available to you.

- Finding a Property and Loan Application: Once you have found a home and are under contract, you will complete or update your full loan application with your lender. At this point, your Loan Estimate will reflect more accurate numbers that are specific to the property you are purchasing.

- Receiving the Loan Estimate: After you submit your full application, you should receive a Loan Estimate from your lender fairly quickly. This document provides a detailed look at projected payments, closing costs, and the amount you may need at closing. Because it is tailored to the specific property, it will be much closer to the final figures you will see later in the process.

- Working with a Trusted Lender: The Loan Estimate is a valuable tool for understanding your loan, but what matters most is having a lender you can rely on. A trusted partner like Homestead Financial Mortgage will walk you through the details, answer questions, and make sure you feel comfortable with the numbers every step of the way.

Breaking Down the Loan Estimate

The Loan Estimate is standardized, so every lender’s form will look the same. That consistency makes comparison easier, but only if you know what to look for.

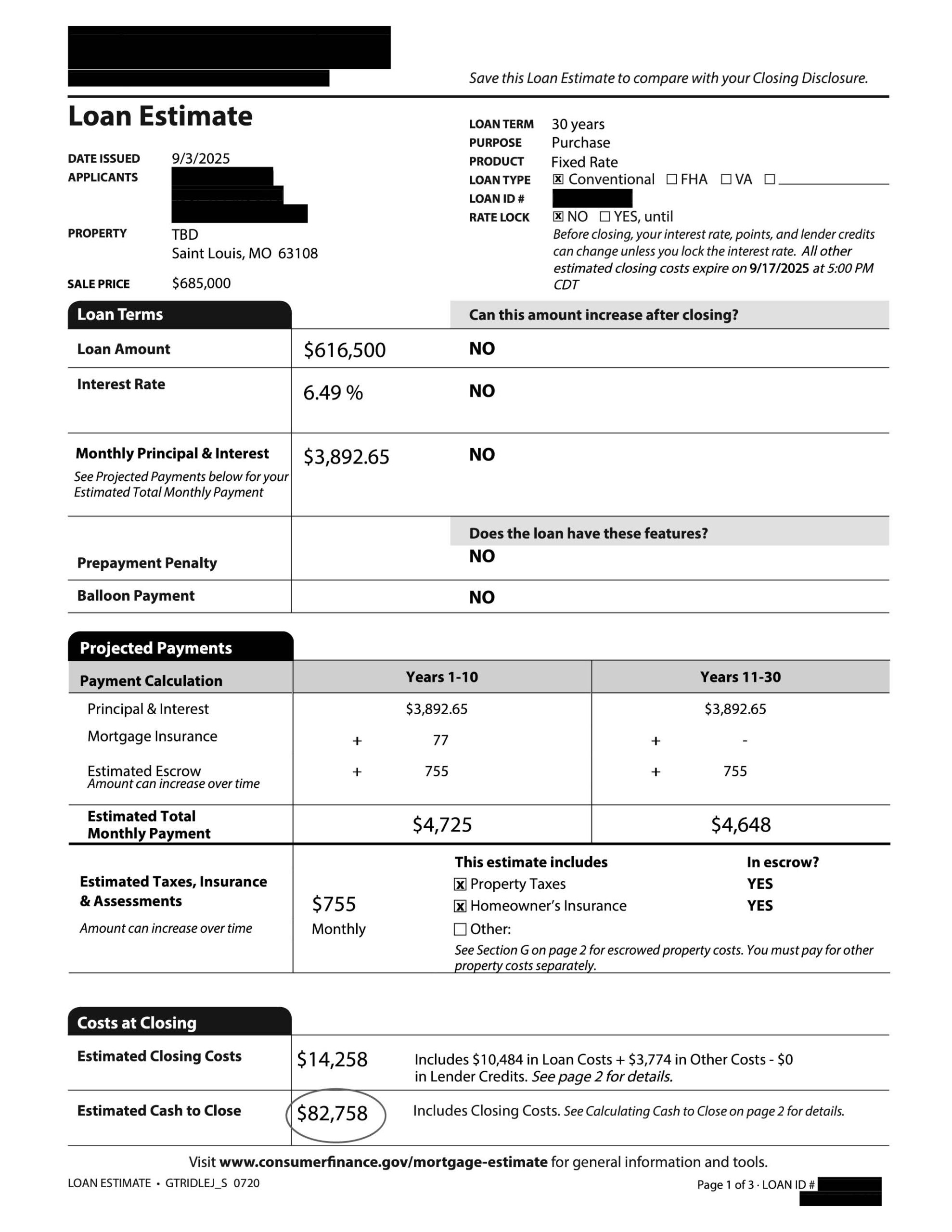

Page 1: The Big Picture Snapshot

The first page is designed to answer your most pressing question: Can I afford this loan?

- Loan Terms – Look for the loan amount, interest rate, and whether these numbers can change after closing. In the sample LE, the loan is for $616,500 at a fixed 6.49% rate, meaning no surprises later.

- Projected Payments – This is more than just principal and interest. It also includes mortgage insurance, property taxes, and homeowner’s insurance. The sample shows a total payment of around $4,725.

- Closing Costs and Cash to Close – This is what you will need upfront. In our example, closing costs are $14,258, and total cash to close (including down payment) is $82,758.

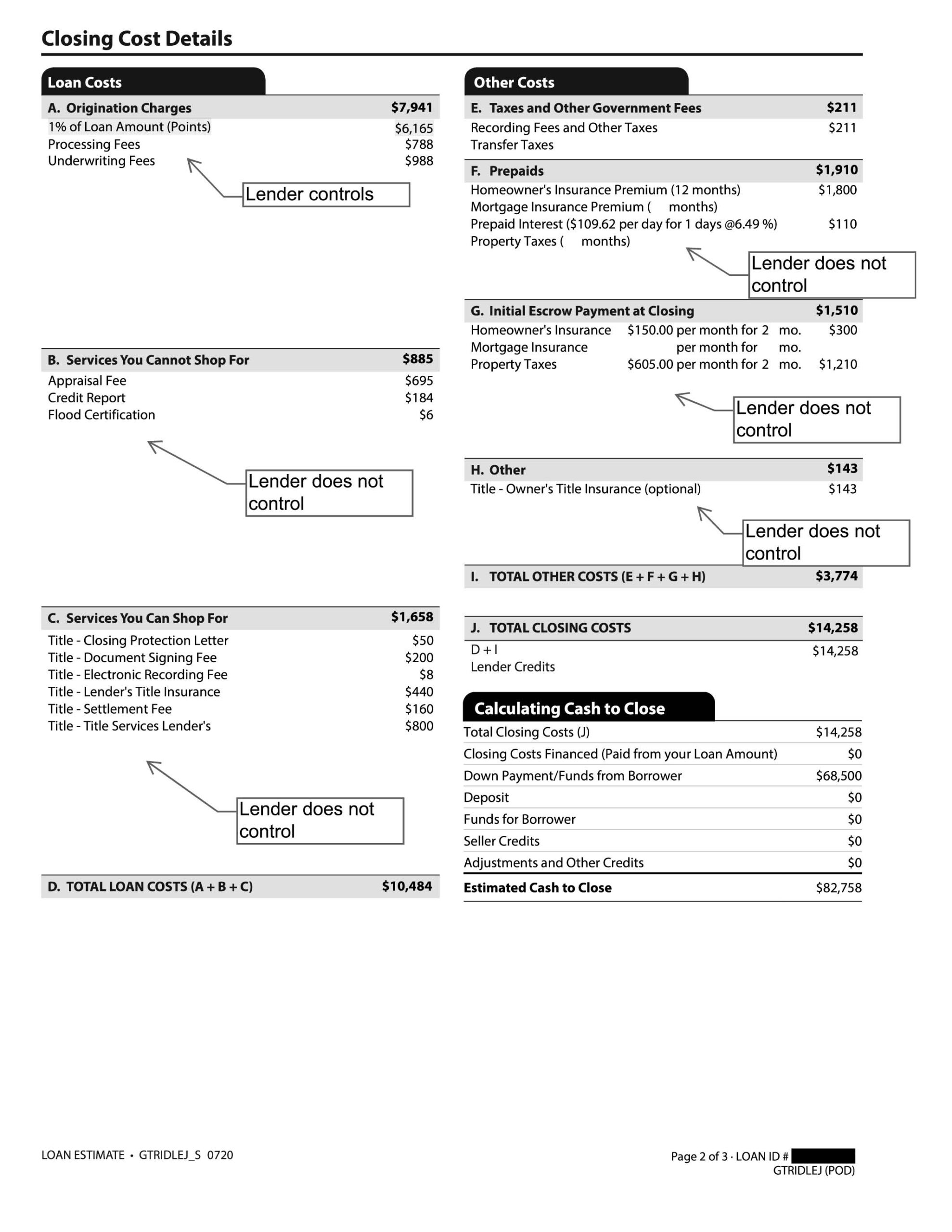

Page 2: The Closing Cost Details

This is where things get technical. Costs are divided into categories:

- Origination Charges – Fees directly controlled by the lender, such as points, underwriting, and processing. These are the easiest to compare across lenders.

- Services You Cannot Shop For – Appraisal, credit report, and flood certification. These costs are set by third parties.

- Services You Can Shop For – Title insurance and settlement services. Here is where you can potentially save by comparing providers.

- Prepaids and Initial Escrow – Upfront property taxes, insurance, and escrow funds. These are not negotiable but are necessary.

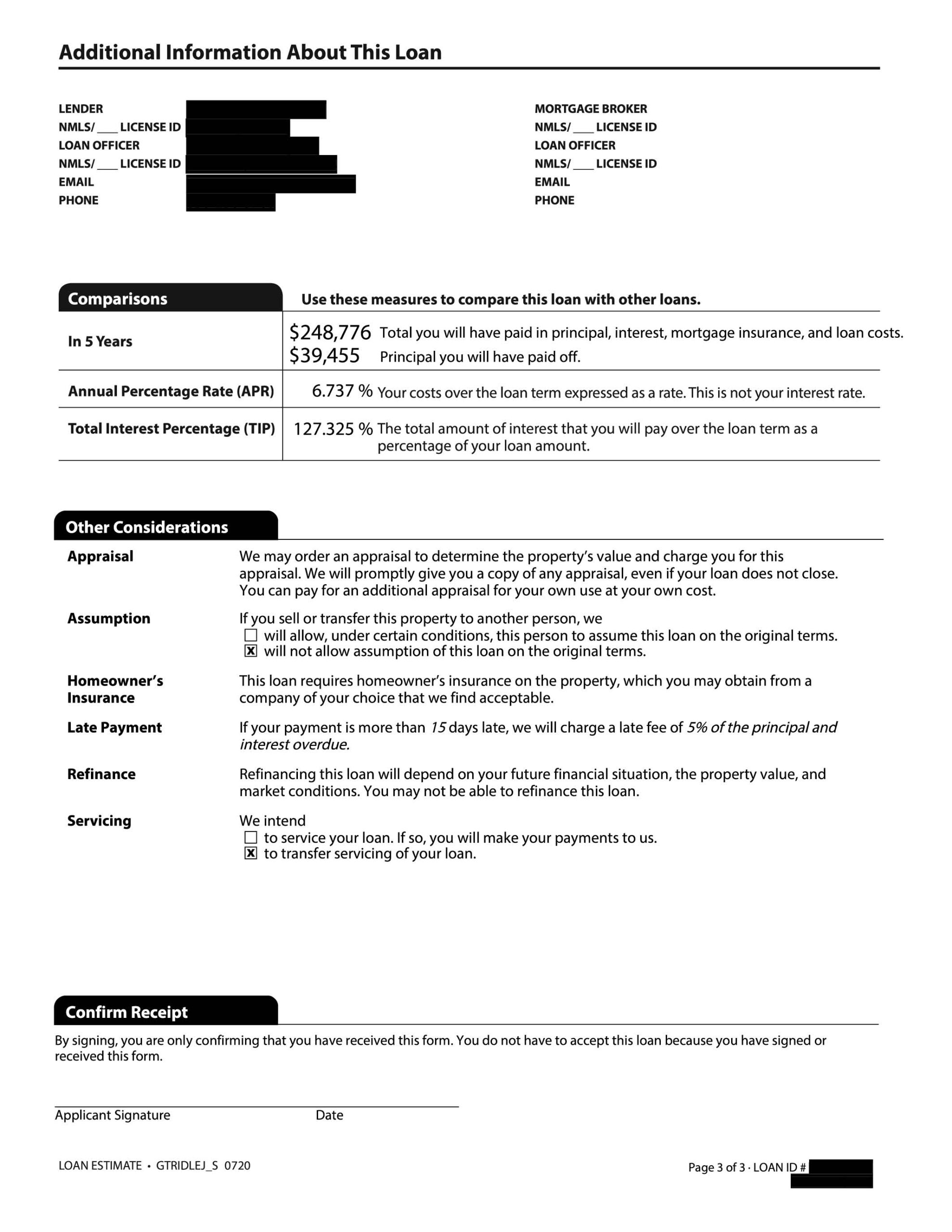

Page 3: Comparisons and Key Terms

This page is all about long-term perspective:

- In 5 Years: This shows how much you will pay in total and how much principal you will have paid off.

- APR (Annual Percentage Rate): This includes both the interest rate and certain fees, giving you a truer cost comparison across lenders.

- TIP (Total Interest Percentage): This is how much total interest you will pay as a percentage of your loan amount. In the sample, it is 127 percent, meaning you will pay more in interest than the original loan balance if you keep the loan for the full 30 years.

- Other Considerations: Assumption rights, late fees, refinancing conditions, and servicing details. These can affect your future flexibility.

What to Pay Close Attention To

- Interest Rate vs. APR – Do not confuse them. The APR often tells the real story once fees are factored in.

- Closing Costs – Origination fees vary widely. Some lenders may charge more upfront, while others spread the costs out.

- Cash to Close – Make sure you are financially prepared for both the down payment and all closing expenses.

- Loan Features – Watch for risky features like prepayment penalties or balloon payments.

- Monthly Escrow Breakdown – Understand how much of your payment is going to taxes and insurance. These numbers are likely to change over time.

How to Use the Loan Estimate to Your Advantage

- Understand the numbers clearly. The Loan Estimate shows you exactly what your monthly payment and closing costs will look like. Knowing how these numbers fit into your budget helps you feel confident moving forward.

- Pay attention to fees. Some costs, such as origination or processing fees, are determined by the lender. A trusted lender like Homestead will always explain these charges upfront so you know exactly what you are paying for.

- Know which services you can choose. Certain items, such as title insurance or settlement services, may allow flexibility. Your lender can guide you through these options to ensure you are comfortable with your choices.

- Ask questions early. If any part of your Loan Estimate feels unclear, lean on your lender for answers. At Homestead Financial Mortgage, we believe there are no bad questions when it comes to understanding your loan.

Final Thoughts

A Loan Estimate is not just paperwork. It is a powerful comparison tool. By reviewing it carefully and knowing what each section means, you can avoid surprises at closing and ensure you are choosing the best possible mortgage for your situation.

Think of it as your financial compass during the homebuying journey. The clearer you are on your Loan Estimate, the more confident you will be in making one of the biggest investments of your life. If you’re ready to apply for a mortgage, just reach out, and one of our loan advisors can help you figure out what you qualify for and what your personalized plan looks like.