Owning a home is a powerful tool for building wealth, as it allows you to grow equity in two significant ways simultaneously. First, by consistently paying down your mortgage balance, you reduce debt while increasing your ownership stake in the property. Second, homes often appreciate in value over time, with an average annual increase of around 4%.

Over the years, the combination of reducing what you owe and benefiting from appreciation creates substantial equity, which can be leveraged for future investments, financial security, or major life goals.

Building Equity Through Mortgage Payments

When you make a mortgage payment, it is typically divided into two main components: interest and principal. In the early years of the loan, a larger portion of your payment goes toward interest, while a smaller portion goes toward reducing the principal balance. This is because most mortgages follow an amortization schedule, where interest is calculated based on the remaining loan balance. Since the balance is highest at the beginning, the interest portion is also at its peak.

As you continue making payments over time, the principal decreases, leading to lower interest charges. This shift gradually increases the amount of each payment that goes toward paying off the principal, helping you build equity in your home faster in the later years of the loan. Over time, your financial stake in the property grows, making homeownership a forced savings plan that benefits you in the long run.

Appreciation: A Long-Term Wealth Builder

Historically, real estate appreciates in value, meaning that homes generally increase in worth over time. While market fluctuations occur, the long-term trend shows an average annual appreciation of around 4%. This growth in value enhances your net worth and can provide a solid return on investment when it’s time to sell.

Around 2020/2021, home values appreciated dramatically due to a combination of low mortgage rates, high demand, and limited housing supply. The Federal Reserve lowered interest rates in response to the economic uncertainty caused by the COVID-19 pandemic, making borrowing more affordable and fueling a surge in homebuying. At the same time, remote work trends led many people to relocate, increasing demand for housing in suburban and rural areas. Meanwhile, supply chain disruptions and labor shortages slowed new home construction, tightening inventory and driving prices even higher. These factors, combined with strong investor activity, created one of the fastest periods of home price appreciation in recent history, with many markets experiencing double-digit percentage increases in property values.

The Math of Home Appreciation

To illustrate how appreciation works, let’s assume you purchase a home for $300,000. With an average annual appreciation rate of 4%, the home’s value would grow as follows:

- After 1 year: $312,000

- After 5 years: $364,996

- After 10 years: $444,073

- After 20 years: $657,337

This compounding effect means that over time, your home becomes a significantly more valuable asset, further reinforcing the benefits of homeownership as an investment.

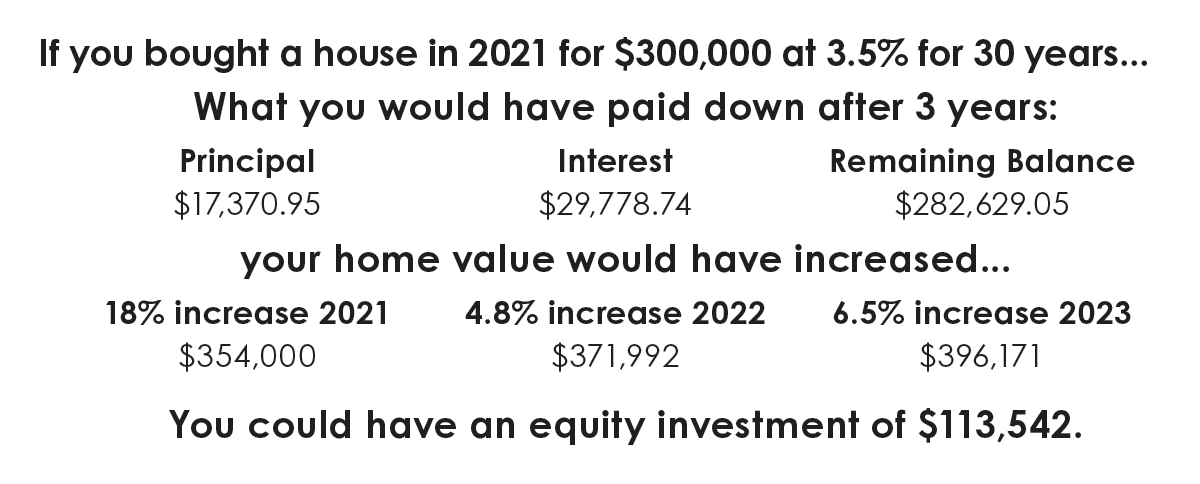

Here is an example of what you could have earned if you had bought a home in 2021.

Leveraging Home Equity

Homeowners can tap into their equity to fund future financial goals. This can be done through a home equity loan, home equity line of credit (HELOC), or cash-out refinancing. These funds can be used for:

- Home improvements that further increase property value.

- Investing in additional real estate.

- Covering education expenses or medical bills.

- Starting a business.

Stability and Predictable Costs

Unlike renting, which often comes with annual rent increases, owning a home—especially with a fixed-rate mortgage—provides predictable monthly housing costs. This stability allows for better financial planning and protection against inflation.

Tax Benefits of Homeownership

Homeowners may also benefit from tax advantages, such as deductions on mortgage interest and property taxes. These incentives help lower overall tax burdens, making homeownership even more financially beneficial.

A Legacy for Future Generations

Real estate is one of the most effective ways to pass down wealth. By owning property, you create a tangible asset that can be inherited by your family, providing financial security for future generations.

Final Thoughts

Buying a home is more than just securing a place to live—it’s a strategic financial decision. Through mortgage payments, appreciation, and leveraging home equity, homeownership provides long-term wealth-building opportunities that renting simply cannot match. If you’re considering purchasing a home, think of it as an investment in your future financial security.