If you purchased a home or refinanced between 2022 and 2025, you may have locked in at one of the highest mortgage rate environments in recent history. The good news is that rates are starting to come back down, and that could mean real opportunities for homeowners who refinance now.

What Is a Refinance?

A refinance, often called a “refi,” is when you replace your existing mortgage with a new one, usually at a lower interest rate. While there are transaction costs involved, the long-term savings can significantly outweigh the upfront expenses.

Over the past five years, we’ve seen dramatic swings in mortgage rates. In 2020 and 2021, rates fell to historic lows as the Federal Reserve lowered interest rates to support the economy during the pandemic. By 2022 and 2023, rates climbed sharply, reaching levels above 7 percent, as the Fed raised rates to fight inflation. In 2024 and into 2025, rates have started to ease as inflation shows signs of slowing and the economy stabilizes.

Mortgage rates typically fluctuate in response to broader economic forces, including inflation, Federal Reserve policy, and demand for mortgage-backed securities. When inflation is high and the Fed raises rates, borrowing costs tend to rise. When inflation cools and the Fed cuts rates, borrowing costs usually decline, which is why today’s market is beginning to create new opportunities for homeowners to refinance.

Why Now Might Be the Right Time

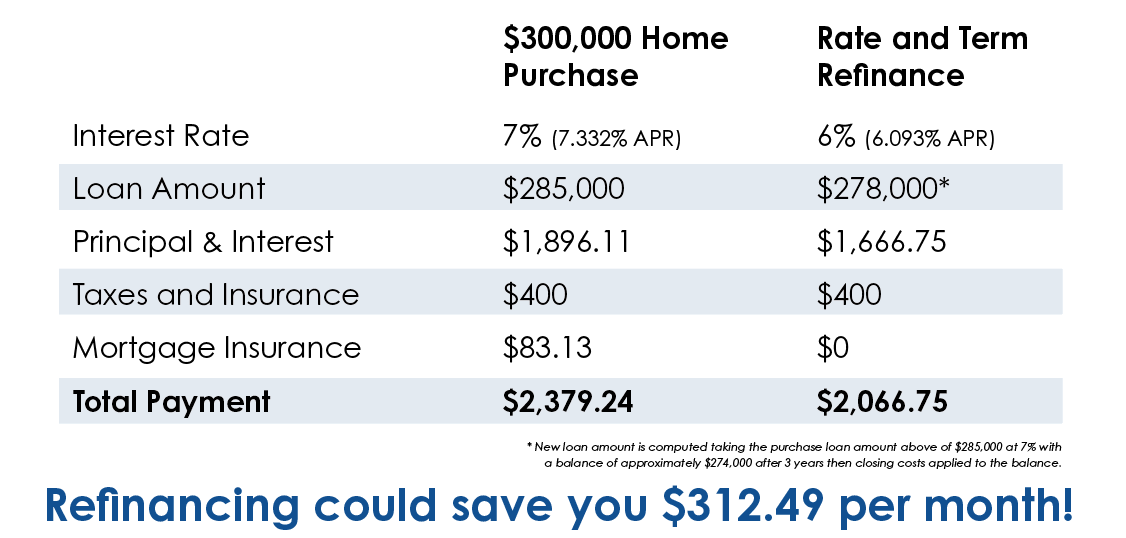

With mortgage rates easing from their highs, even a 1 percent drop can make a noticeable difference to your monthly budget.

Consider the following scenario: John and Michelle purchased their home in 2022 with a $290,000 FHA mortgage. In 2025, they could refinance into a lower rate, waive their mortgage insurance, and cut their monthly payment by about $300.

Not only is this a monthly savings of over $300, which could significantly impact your monthly budget, but it also potentially results in thousands of dollars in interest and insurance savings over the life of the loan.

So, the question becomes: What is the smartest way to use those savings?

- Pay Down Your Mortgage Faster

Applying your savings directly back into your mortgage can help you cut years off your loan term. What many homeowners do not realize is that in the early years of a mortgage, the bulk of their monthly payment goes toward interest, not principal. This is because amortization schedules are structured in a way that lenders collect more interest upfront, and only gradually does a larger portion of your payment start to reduce the balance of your loan.

By making extra payments each month, you can reduce the principal more quickly. A smaller principal balance means less interest is charged in future months, which creates a compounding effect of savings. Even modest additional payments can significantly reduce the length of your loan.

In John and Michelle’s case, putting their $300 monthly savings back into their loan allows them to pay off their mortgage in 20 years. In our refinance scenario, that could mean saving almost $116,000. The faster you chip away at the principal, the more you cut into the interest the bank would otherwise collect over time.

- Invest the Money for Long-Term Growth

While paying off your home quickly can be very appealing to many people, another powerful option is to invest the savings. If John or Michelle increases their 401(k) contributions by $300 each month and those funds are invested in an S&P 500 index fund with historical average returns, after 20 years, they could have an additional $260,000 for retirement.

This is one of our favorite recommendations, but it does require you to carefully examine the numbers for your situation and have a stable source of income to make continuous investments. If you invested $300 per month in an S&P 500 index fund for 20 years, using the historical average annual return of about 10%, the outcome would look like this:

- Total contributions: $72,000 (300 × 12 × 20)

- Future value after 20 years: about $229,709

- Growth from compounding (investment gains): about $157,709

This illustrates the significant impact of long-term investing. Most of the final balance is not money you put in directly, but the result of compounding growth over time. Compounding works best when you start sooner, so even small monthly contributions can grow into substantial wealth over time.

- Improve Your Lifestyle

Not every dollar from your refinance savings needs to go into your mortgage or investments. Sometimes the most valuable choice is to use that extra cash to improve your everyday quality of life. For many families, an extra $300 per month can relieve financial stress and create opportunities that were harder to fit into the budget before refinancing.

You might choose to set aside part of the savings for experiences such as family vacations, hobbies, or dinners out, which can strengthen relationships and create lasting memories. Others may prefer to direct the money toward practical goals, such as building an emergency fund, starting a college savings account, or making home renovations. Upgrading your home to make it more comfortable or better suited to your style not only improves your day-to-day living but can also add long-term resale value when it comes time to sell.

The key is balance. Refinancing provides flexibility, and using the savings to improve comfort and peace of mind today can be just as important as planning for the future.

The Bottom Line

If you purchased or refinanced in the last few years when rates were higher, it may be worth giving your lender a call to explore your refinance options. Even small changes in your interest rate can unlock hundreds of dollars a month—money that can pay down your mortgage faster, grow your investments, or improve your lifestyle.

A refinance is not one size fits all, but if you are six months past your original purchase or last refinance, you may already be eligible. Give us a call today, and we’ll be happy to discuss your options with you.