Refinancing your mortgage can be one of the smartest financial decisions you make, especially when interest rates start to improve, or you want to reduce your monthly expenses and consolidate debt.

One of the first questions homeowners ask is: “How long does the refinance process take?” If it’s been at least 6 months since closing, you can refinance your loan. In most cases, refinancing can be completed in 3 to 4 weeks, as long as the borrower stays on top of submitting documents and responding to the lender. With a little preparation and clear expectations, the process can feel straightforward and smooth.

Why More Homeowners Are Refinancing Now

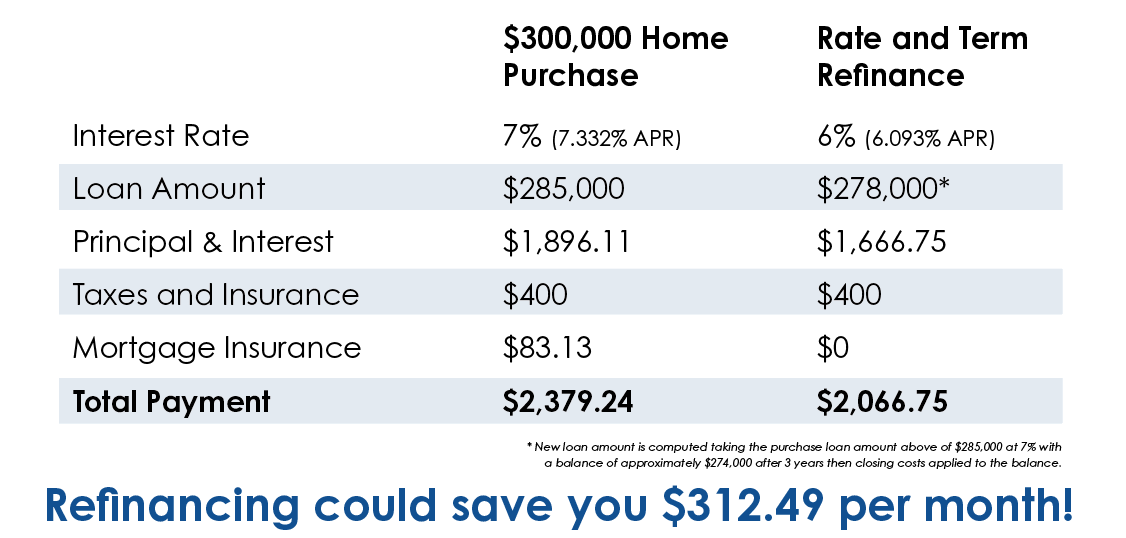

When interest rates drop, a mortgage refinance becomes a valuable tool to lower your payment, eliminate mortgage insurance, or secure better long-term financial stability. For example, John and Michelle purchased their home in 2022 with a $290,000 FHA loan at around 7%. In 2025, by refinancing into a lower rate and removing their mortgage insurance, they’d cut their monthly payment by roughly $300, putting hundreds back into their budget every month. If you bought or refinanced when rates were in the 6–7% range, the current market might offer significant savings.

How Long Does a Refinance Take?

The typical mortgage refinance process takes about 3 to 4 weeks. Every refinance is unique, though most follow the same general timeline. Here’s what to expect from start to finish:

Week 1: You complete your application, receive initial disclosures, and begin submitting documents. Most lenders will request several standard documents during this first stage, including:

- Recent pay stubs

- Bank statements

- Homeowners insurance information

- W-2s or tax returns

- Your current mortgage statement

Submitting these as quickly as possible, ideally within 24–48 hours, helps keep the process moving smoothly and prevents delays.

Week 2: Your lender reviews documents and orders an appraisal (if needed). Not all loans require an appraisal, but if yours does, the visit and report typically occur within a few days. Your file then moves to underwriting, where the underwriter may request clarification or additional documents. Quickly responding to these “conditions” is one of the best ways to prevent delays.

Week 3: Your file goes through final underwriting, and once everything is cleared, you’ll receive your Closing Disclosure. This outlines your final loan terms. After signing the CD, a mandatory three-day waiting period begins before closing can be scheduled.

Week 4: You attend your closing appointment, sign final documents, and the new loan is funded. From here, your old mortgage is paid off, and your new loan officially begins.

Why Borrowers Often Skip Two Months of Payments

Many borrowers are surprised to learn that refinancing can allow them to skip up to two months of mortgage payments. Because mortgage payments are made “in arrears”, meaning your monthly payment is for the previous month of the loan, your new loan won’t require a payment until the next full month after closing. For example, if you close in late October, your next payment may not be due until December, effectively skipping November and December payments. This can provide meaningful financial breathing room.

What Does a Refinance Cost? Understanding Out-of-Pocket Expenses

Homeowners often ask if refinancing will require any out-of-pocket costs. The good news is that with Homestead Financial Mortgage, it costs nothing to apply, nothing to review your options, and nothing to see what you qualify for. Your loan advisor can run scenarios, check your rate eligibility, and provide a full breakdown of potential savings at no cost to you.

However, as with any real estate transaction, there are closing costs associated with a refinance. These typically include lender fees, appraisal fees (if required), title work, and prepaid items like interest, taxes, and homeowners’ insurance. While amounts vary by state and loan type, most homeowners can expect total refinance costs to range from 2% to 3% of the loan amount.

The important part to note here is that you usually don’t pay these out of pocket at closing.

Most refinances allow the costs to be rolled into the new loan amount or covered with lender credits, so many borrowers complete their refinances without bringing any money to closing.

Understanding the Escrow Refund

If your previous lender held money in an escrow account for taxes and insurance, you will likely receive an escrow refund within 30–45 days after the refinance closes. This refund can range from a few hundred to several thousand dollars, depending on how much had accumulated, making it a potentially helpful boost of cash.

Communication & How to Keep Your Refinance Moving Smoothly

Throughout the refinance process, you can expect steady, predictable communication from your loan advisor. You’ll receive updates when your application is submitted, when documents are needed, when your file enters underwriting, if any additional items are required, when your appraisal is completed, and when your Closing Disclosure and closing date are ready. Most borrowers hear from their loan advisor at least once or twice per week, but you should never be left wondering—your lender at Homestead Financial Mortgage is available 24/7, so you can always reach out if you have questions or need clarification at any stage.

To help keep your refinance on track, there are a few things you can do on your end:

- Submit requested documents quickly, ideally within 24–48 hours.

- Check your email and texts daily for follow-up questions from your loan advisor or underwriting conditions.

- Avoid opening new credit accounts, changing jobs, or making large unexplained deposits, as any of these actions can change your loan and potentially disqualify you from being able to refinance.

Making the Most of Your Refinance Savings

Lowering your monthly payment by hundreds of dollars, skipping up to two months of payments, and receiving an escrow refund can free up valuable cash flow. Many homeowners use this extra cushioning for holiday expenses, paying down high-interest debt, starting an emergency fund, tackling home improvements, or preparing for new financial goals in the upcoming year. You can also explore our guide on what to do with your refinance savings for more ideas.

Is Now the Right Time to Refinance?

If you purchased or refinanced when rates were higher, today’s market might offer an opportunity to lock in a better rate, drop mortgage insurance, and improve your financial outlook. With most refinances completing in just 3 to 4 weeks and the potential to significantly lower your monthly payment, now may be a great time to explore your options.