Refinancing to consolidate credit card debt can be a smart financial move to help simplify monthly payments, protect your credit score, and help free up extra monthly cash. If you’ve been feeling the stress of increased credit balances, you are not alone. Below we’ll walk you through an example of how you can use our mortgage calculators to run the numbers of your credit card debt and see if a refinance could help you save.

Benefits of consolidating credit card debt through refinancing

Simplify payments

With multiple credit card balances to manage, keeping track of due dates and minimum payments can be daunting. Consolidating your debt into a single loan payment can simplify your finances and make it easier to stay on top of your payments.

Protect your credit score

If you’ve been carrying high balances on multiple credit cards, your credit score may have taken a hit. By consolidating your debt and paying it off with a new loan, you can improve your credit utilization ratio, which is one factor that impacts your credit score. Also, if you make a late payment when you’re balance is maxed out, you could damage your score even further.

Free up monthly cash

If your cards are maxed out, your monthly payments might be eating up a lot of your cash flow, making day-to-day living stressful. By doing a cash-out refinance, you will use some of the equity in your home to pay off your high-balance credit cards and free up some of the money you were using to make those monthly payments.

How does a refinance with cash out help protect my credit score during debt consolidation?

High credit card balances can have a negative impact on a person’s credit score because they increase their credit utilization rate. Credit utilization is the ratio of the amount of credit used to the total available credit limit, and it is an essential factor in calculating credit scores. Higher balances can lead to a lower credit score which may result in higher interest rates and reduced access to credit in the future. Therefore, it is important to maintain low credit card balances and keep credit utilization rates below 30% to help protect and improve one’s credit score.

Missing a credit card payment when your cards are maxed out can potentially have a greater impact on lowering your credit score than one missed when your balances are lower. This can set borrowers into a dangerous cycle of playing catch up from credit card debt and not having good enough credit to qualify for new loans and constantly needing to utilize any free credit they may free up with their payments, constantly keeping their cards maxed out. A good credit score will have a big financial impact on your life.

Why Minimum Payments Don’t Work For Credit Card Debt

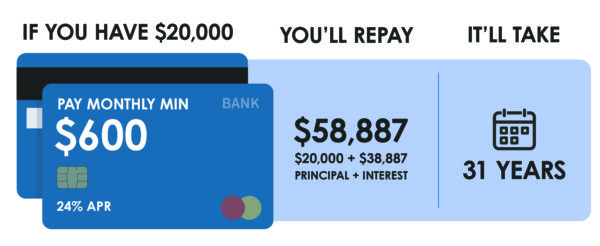

Minimum payments on credit cards only pay off a small percentage of what you owe each month – usually about 2-5%. At the same time, you have a high APR that’s eating up a significant portion of each minimum payment you make.

At 20% APR, two-thirds of every payment made is used to cover accrued interest charges. This is why you can make payments month after month, but you never seem to get anywhere – especially if you’re still making charges to the card each month.

So, if you really want to pay off your credit card balances effectively, you need to find solutions that are more practical than minimum payments.

How much can you save by paying off high-balance credit cards with high-interest rates?

Let’s run some numbers through our calculators to help you get an idea of how much you can save monthly by refinancing and consolidating your debt.

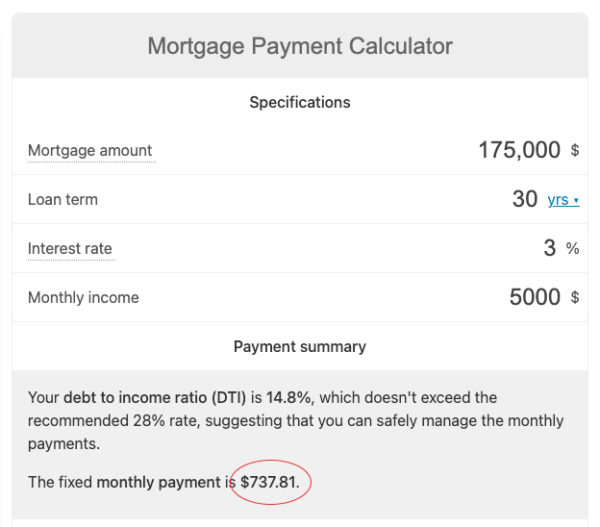

Let’s say you bought a home for $175,000 at 3% for 30 years. Using our Mortgage Payment Calculator, you can see that your monthly payment would be $737.81 (not including taxes and insurance).

Let’s say you bought a home for $175,000 at 3% for 30 years. Using our Mortgage Payment Calculator, you can see that your monthly payment would be $737.81 (not including taxes and insurance).

Now let’s say you have 3 credit cards – all of which are maxed out. One at $20,000 with a monthly payment of $600, another at $12,500 with a monthly payment of $375, and the last one at $7,500 with a monthly payment of $250. This leaves you with a total monthly minimum credit card payment of $1200. That, plus your current mortgage, is going to come to a total of $1937.81.

A few years have passed since you first got your mortgage, and you will have paid down your loan, increasing your equity. Plus, your home value will likely have increased, which also increases the available equity in your home.

This is where a refinance can come into play. By refinancing your home at a new higher valuation, you can take cash out of your home. But rates have increased since you first bought your home, so is it worth it to give up your lower rate to consolidate your debt? Let’s look at the numbers.

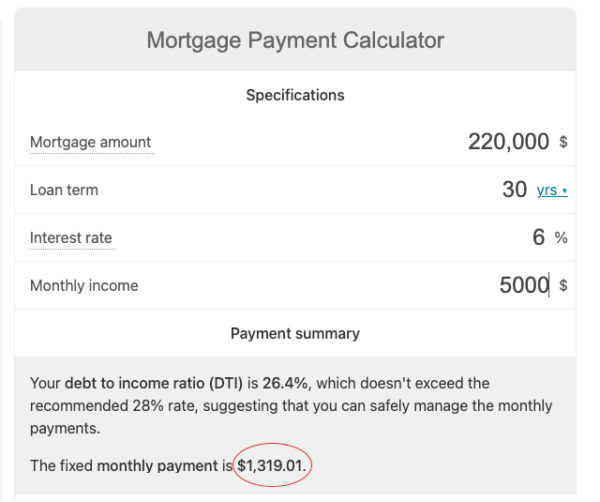

Let’s say that your home now is worth more and you can refinance your loan for $220,000 and pull out $40,000 to pay off your credit cards.

Let’s say that your home now is worth more and you can refinance your loan for $220,000 and pull out $40,000 to pay off your credit cards.

Your new monthly payment for a loan of $220,000 at 6% for 30 years is going to be $1,319.01 (this does not include taxes and insurance).

You were paying $1937.81/month with your old payment and credit card debt. Now with your new payment of $1,319.01, you’re saving $618.80 a month! This could make a huge difference in your family’s monthly budget and get you out from under credit card debt that, at minimum amounts paid, could take 20 years or more to pay off. As well as having the advantage of no longer having multiple payments to remember and pay every month – now there is a single payment.

If you’ve run the numbers through our calculators and think a refinance might help you save or simply want to speak with a mortgage professional to help figure out your numbers – reach out to our experienced team of Homestead Financial Mortgage Loan Advisors. With Homestead, it costs Nothing Out of Pocket (NOOP) to apply. Give us a call and see how we can help take some financial burden off your monthly expenses.