Are you a homeowner with too much credit card debt? This article can help you decide if you should take a cash-out mortgage to pay off credit cards. The cash-out refinance of your existing home allows homeowners to convert their real estate equity to cash.

Cash-out from a refinance can be used for nearly any purpose, like starting a business or home improvements. In this case, to pay off high-interest debt like credit cards or personal loans.

If you’ve got debt – you’re not alone. According to the New York Federal Reserve, in the 4th quarter of 2022, credit card debt reached nearly 1 trillion dollars. That’s a Trillion with a “T.” This debt carries an average interest rate above 20%. There have been significant changes in both savings and credit card debt trends nationwide.

We will be discussing when you should choose a debt consolidation loan. We’ll also break down the consequences it may have on your financial future if you make a late payment. Finally, we’ll cover the process of getting a debt consolidation mortgage to pay off credit cards.

How do I know if I should put my credit debt into my mortgage?

“Too much month left at the end of your money?”

If that hits home, or you are “maxed out” on your credit card balances, say over 50%, then keep reading. “Maxed out” means your credit card balances are at or near their credit limit.

You need a calculator, a mortgage calculator, and your credit card statements to do some quick math. Add all the monthly payments against a proposed new mortgage payment. If a new mortgage saves you a lot of cash flow, then you should consider consolidating your credit card debt. Check out a deep dive into the math here.

Your household is like a business. Like all businesses, it runs on cash flow. If cash flow is tight, then restructuring debt is a common technique to improve cash flow and save money.

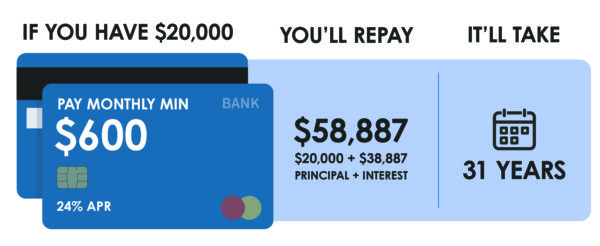

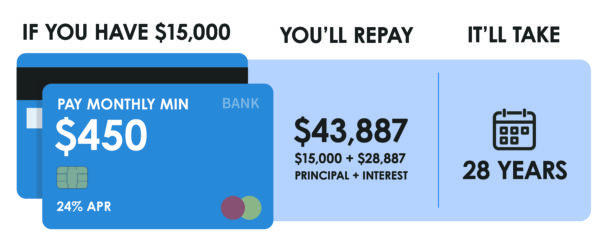

Credit cards carry the highest interest rates of any debt. This makes restructuring credit card debt into a mortgage attractive even if mortgage rates are elevated – 29% on credit cards vs. 7% on mortgages. Credit card debt can also be carried for years by making only the minimum payment.

Having high balances on your credit cards can harm your credit score due to an increase in your credit utilization rate. Credit utilization is the proportion of your used credit compared to your total available credit limit, and it plays a crucial role in determining credit scores. When your balances are higher, it can lead to a lower credit score, resulting in potential consequences such as higher interest rates and limited access to credit in the future.

The value of a high credit score and the consequences of making a late payment on your debt.

If you miss a credit card payment while carrying maxed-out balances, the impact on your credit score can be even more significant compared to missing a payment when your balances are lower. This situation can create a dangerous cycle where you constantly struggle to catch up financially and find it difficult to qualify for new loans due to poor credit.

If the possibility exists that you could pay your debts 30 days late, consider taking cash out to consolidate your debt. If there is a late payment on any of your debts, it can have a large impact on your credit score. A late payment can affect your score by as many as 180 points and can stay on your report for up to seven years.

While rates can vary based on equity and FICO score, the minimum FICO score needed starts at 620 and maximum equity which can be used for cash is 80%.

If you’ve always had a high credit score, then you’ve probably enjoyed the benefit of low borrowing costs. However, a low credit score can keep you in a bad financial cycle which is hard to break.

A bad “cycle” can look like this:

- You have high payments on debts because you have a low credit score.

- You have a low credit score because you have high payments which get made late.

Having credit cards close to their limit can have a negative impact on your credit score. If you then make a late payment, your score will drop significantly more.

The Process of Getting a Mortgage to Payoff Credit Cards.

If you’ve never gotten a mortgage to consolidate debt, then this is what the process looks like with Homestead Financial.

When you decide to complete a mortgage application with Homestead Financial, all these services are rendered at no charge out of pocket.

- 1st Communication. This initial conversation will be by phone call, text, email, etc.

- Preliminary figures. After discussing goals, a Letter of Proposed Accomplishments (LOPA) is sent to address the borrower’s goals. We also establish the legal standard of Net Tangible Benefit for the refinance.

- Disclosures sent and returned. Usually sent electronically, this will include your Loan Application (1003), Loan Estimate (LE), and other disclosures.

- Processing. After a quality check to get into processing, we will be ordering:

- Appraisal

- Title

- Follow up documentation to submit to underwriting.

- Underwriting. Underwriting will validate the income, employment, assets, and valuation of the collateral. We will also discuss locking the rate on your mortgage at this step. Once complete, we will issue a “Conditional Approval,” which will ask for updated documents and minor explanations.

- Clear to Close or (CTC). After reviewing those documents, we will issue the Clear to Close or CTC. You should receive a preliminary Closing Disclosure or CD.

- Document preparation. Closing documentation is prepared, and figures are sent to the title company to balance the transaction. The notary will coordinate a closing time and place to collect the signatures. The closing can often be at your home.

- Closing. Closing documentation is signed either at home or at your chosen place. After a 3 business day right of recission, which includes most Saturdays, your loan funds.

Your former mortgage is paid off by the title company.

Some checks maybe be required to be paid directly to your creditors. Some you will receive made payable to cash. Make sure to put your credit card statements with the checks sent in to avoid confusion.

- Post closing. You should receive a check from your previous mortgage servicer for what was paid into escrow. Those are your funds to keep. You should then receive a package from your new servicer.

People are currently holding record amounts of credit card debt. Due to a real estate inventory shortage, homes are worth more than ever, leading to a record amount of equity. This home equity presents a great opportunity to pay off high-interest credit cards with a mortgage. A debt consolidation loan can save homeowners thousands of dollars to help secure their financial future.