When you’re in the process of buying a home—especially if it’s your first time—you’ll likely come across the term mortgage insurance. It’s not the most exciting part of homeownership, but understanding what it is, and how it affects your monthly payments, can save you confusion, and potentially even money, in the long run.

Let’s break it down in a way that makes sense without diving too deep into the weeds.

The Basics of Mortgage Insurance

Mortgage insurance is designed to protect the lender, if the borrower is unable to make their mortgage payments. In the event of a default, the insurance helps the lender recover a portion of the unpaid loan balance, which reduces their financial risk. This protection is especially important in situations where the borrower puts down less than 20%, since smaller down payments are statistically linked to a higher likelihood of default.

While it might sound like mortgage insurance only benefits the lender, mortgage insurance actually helps homebuyers as well, particularly those who don’t have the means to save for a larger down payment. Without mortgage insurance in place, many lenders would be unwilling to offer loans to buyers with limited savings or lower credit scores. In fact, according to industry data, mortgage insurance has helped millions of families qualify for a mortgage they otherwise wouldn’t have been able to obtain. So, even though it’s an added cost, mortgage insurance plays a key role in making homeownership more accessible and achievable for a wider range of buyers.

Two Main Types: PMI and MIP

There are two primary types of mortgage insurance you might encounter, depending on the kind of loan you choose.

Private Mortgage Insurance (PMI) comes into play when you’re using a Conventional loan and your down payment is less than 20%. This insurance is provided by private companies and typically gets added to your monthly mortgage bill. The good news is that once you’ve built up enough equity in your home, usually when you’ve paid off about 20% of your loan, you can often stop paying PMI altogether.

On the other hand, Mortgage Insurance Premium (MIP) is required for loans backed by the Federal Housing Administration (FHA). These loans are popular with first-time buyers and those with lower credit scores, but the insurance works a little differently. With FHA loans, you pay an upfront insurance fee at closing, plus a monthly amount as part of your mortgage payment. Depending on your down payment and loan terms, MIP might be required for the entire life of the loan.

It’s important to know that mortgage insurance, whether it’s PMI or MIP, is completely different from homeowners insurance. Homeowners insurance protects your property, covering things like fire, theft, or storm damage to the home itself. Mortgage insurance, on the other hand, protects the lender in case you can’t make your loan payments. While both are typically included in your monthly mortgage bill, they serve different purposes—one safeguards your home, the other safeguards the loan.

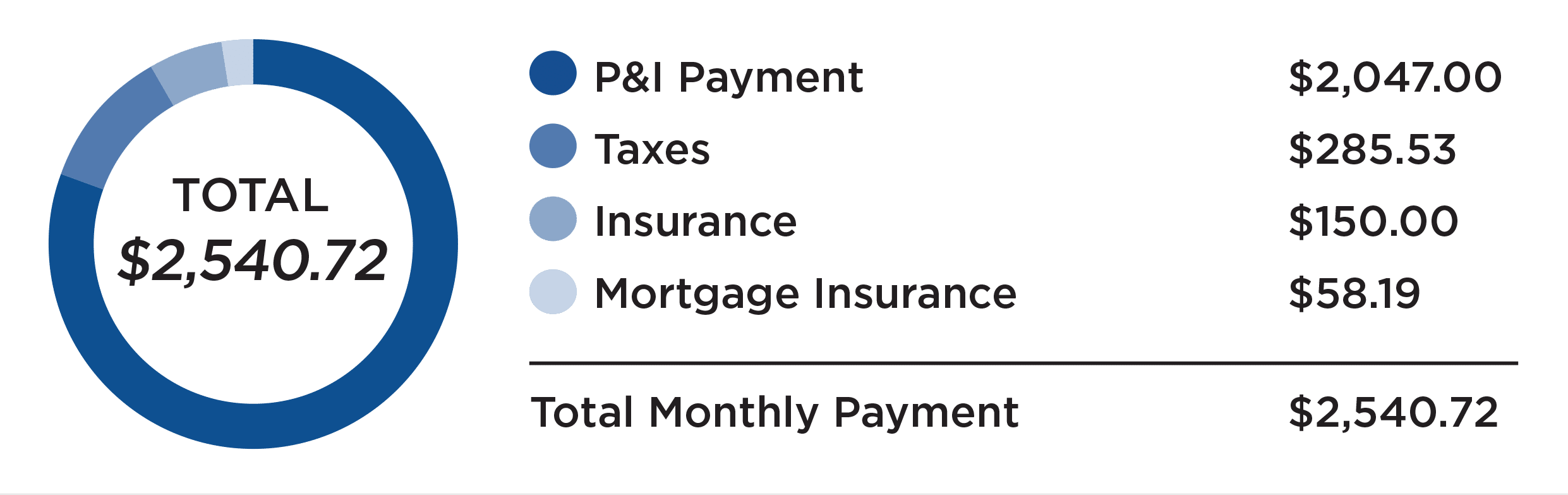

How It Affects Your Monthly Payment

Whether you’re paying PMI or MIP, it becomes part of your overall monthly mortgage cost. Alongside your loan payment, you’ll also be covering property taxes, homeowners insurance, and, if applicable, mortgage insurance. This means your monthly housing cost may be higher than expected, even if your loan amount and interest rate seem manageable.

It’s important to talk with your lender about how much the mortgage insurance will add to your payment. They can help you understand how long you’ll be expected to pay it and what options exist for removing it in the future.

Which Type Applies to You?

The type of mortgage insurance you’ll need depends entirely on the kind of loan you choose. If you’re going with a Conventional loan and putting down less than 20%, PMI is usually required. If you’re choosing an FHA loan, MIP is a standard part of the package regardless of your down payment, though in some cases it can eventually be dropped. Other types of loans, like VA loans for Veterans or USDA loans for rural homebuyers, have different rules and may not require traditional mortgage insurance at all.

| Loan Type | Insurance Type | Required When | Can Be Removed? |

| Conventional | PMI | Down payment < 20% | Yes (at 78–80% LTV) |

| FHA | MIP | Always required | Only sometimes (see above) |

| VA Loans | None | No mortgage insurance required | N/A |

| USDA Loans | Annual Guarantee Fee (similar to MIP) | Always required | No, unless you refinance |

Benefits of a Larger Down Payment

Putting more money down upfront can significantly reduce your long-term costs, especially if it helps you avoid private mortgage insurance. For example, let’s say you’re buying a $300,000 home with a Conventional loan. If you put down 10%, you would likely pay PMI, which could add around $150 to $250 a month to your mortgage. Over five years, that’s an extra $9,000 to $15,000 just in insurance premiums. But if you’re able to put down 20%, you can avoid PMI altogether, lowering your monthly payment and potentially saving you thousands. While a larger down payment might feel like a stretch at first, it can offer meaningful savings over time and help you build equity in your home more quickly.

Need Help Figuring Out What’s Right for You?

While FHA loans can be more accessible, the long-term cost of MIP might make a Conventional loan with PMI the better option if you can qualify. And if you’re close to that 20% down payment threshold, increasing your down payment can help you avoid PMI entirely, potentially saving thousands.

This is where a trusted lender like Homestead Financial Mortgage can help – our loan advisors are here to help you explore all your options based on your credit, income, and homeownership goals. Reach out today to learn more.