Tackling the Homebuyer Affordability Crisis | Part 1 of 4

According to recent data from the National Association of Realtors®, the median age of today’s first-time homebuyer has increased from 38 to 40, highlighting the growing challenges many individuals and families face in achieving homeownership.

While market conditions and affordability continue to evolve, one thing remains consistent: buyers who understand the process and plan ahead are better positioned for success.

This article is the first in a four-part series focused on the most common first-time homebuyer scenarios we see today. In this opening piece, we’ll outline the framework used throughout the series and explain how different timelines and situations impact the path to homeownership.

The upcoming articles will focus on:

- Buyers planning to purchase within the next year

- Buyers preparing to purchase within the next five years

- Parents, family members, and other stakeholders who are helping someone become a homeowner

To keep this series clear and consistent, we’ll use the same framework lenders rely on when evaluating mortgage readiness, commonly known as the Four C’s: Credit, Capacity, Capital, and Collateral.

Credit: More Than Just a Score

Credit is more than a single number. Lenders review your full credit profile, including your payment history, length of credit use, and how you manage revolving accounts such as credit cards.

Late payments, collections, or high credit balances can impact approval, even when a credit score appears acceptable. Strong credit reflects reliability and responsible financial habits, making it a key starting point for first-time homebuyers.

Capacity: Your Ability to Repay the Loan

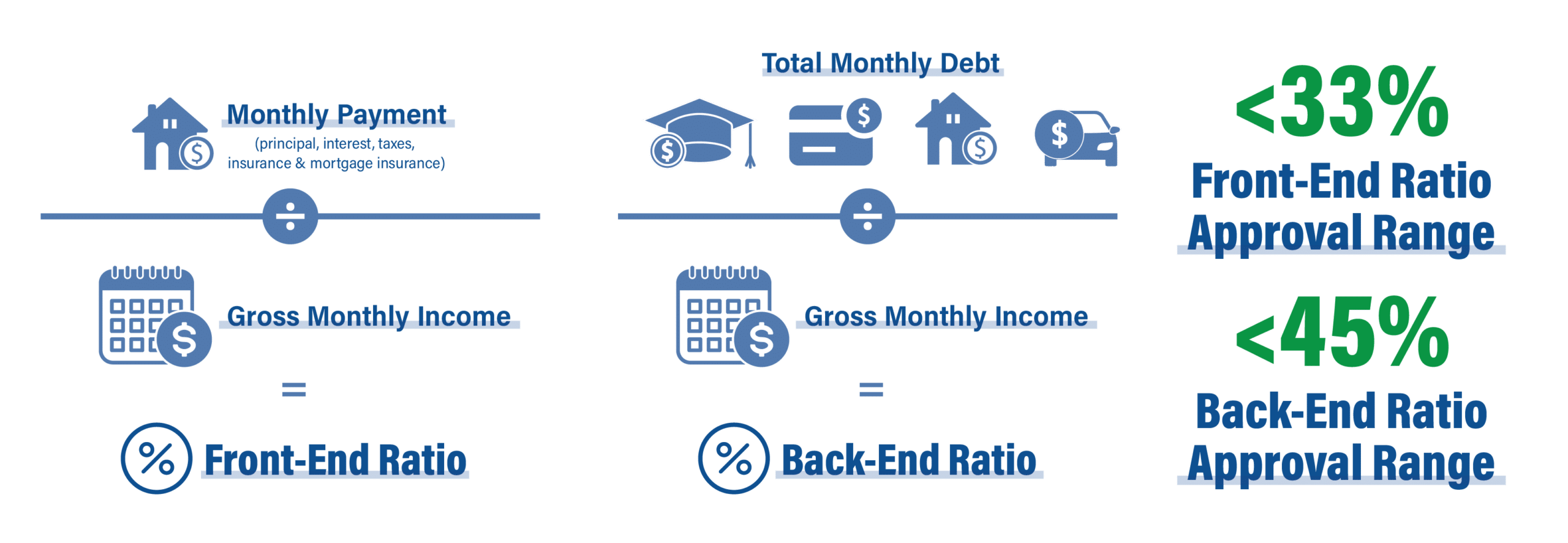

Capacity refers to your ability to afford a mortgage based on your income and existing debts. Lenders are required to confirm a borrower’s ability to repay the loan using debt-to-income ratios, or DTI.

The front-end DTI compares your estimated monthly mortgage payment to your gross monthly income. A common guideline is 33 percent or less.

The back-end DTI includes the mortgage payment plus other monthly debts such as car loans, student loans, and credit cards. The general guideline is 45 percent or less.

Example:

John and Michelle earn $10,000 per month. Their mortgage payment is $2,000, with $1,500 in other monthly debts.

- Front-end DTI: 20 percent

- Back-end DTI: 35 percent

With both ratios within standard guidelines and solid credit, they would typically qualify for the mortgage payment.

Capital: Funds Needed to Close

Capital refers to the funds needed to complete a home purchase, including the down payment, closing costs, and prepaid expenses.

Down payments commonly range from 5 percent to 20 percent, depending on the loan program. In addition, buyers should plan for closing costs and prepaids, which often total between $6,000 and $10,000, depending on the home price, taxes, and insurance.

In some cases, these costs can be negotiated so that the seller pays them. Understanding capital requirements early helps buyers plan and avoid surprises at closing.

Collateral: The Property Being Financed

Collateral is the property itself. In a mortgage, the home serves as security for the loan, so lenders evaluate the property to ensure it meets loan guidelines.

For this series, we’ll focus on common first-time buyer property types, including owner-occupied single-family homes, condominiums, and two to four-unit residential properties where the buyer lives in one unit.

Property condition, occupancy type, and marketability all play a role in loan approval and financing options.

What’s Next in This Series

The “Four C’s” provide a clear framework for understanding mortgage qualification, but how they apply depends on timing and individual circumstances.

In the next three articles, we’ll break this framework down for buyers planning to purchase within the next year, those preparing for the next five years, and families or stakeholders helping someone reach homeownership sooner.